WTI Crude Futures - Stay Long to Ride the Rebound

rhboskres

Publish date: Fri, 07 Dec 2018, 04:23 PM

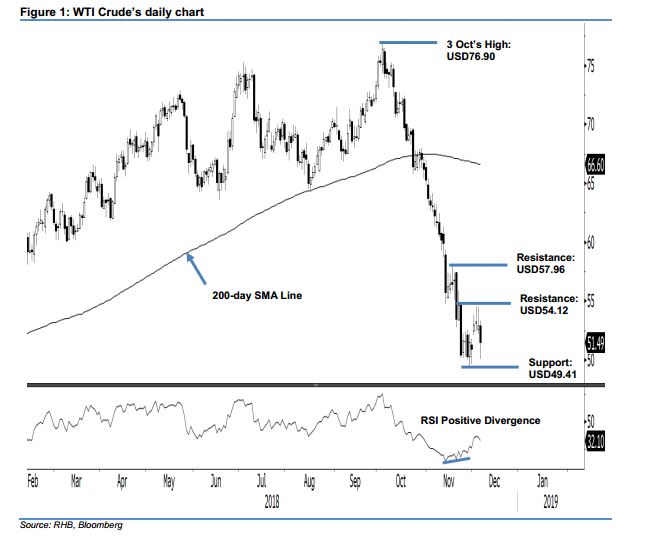

Maintain long positions on the expectation of a deeper rebound. The WTI Crude performed weakly in the latest session after it experienced a volatile trading range. For the intraday, it swung between a low and high of USD50.08 and USD53.30 before ending at USD51.49 – this implies a USD1.40 decline. The weak session has not altered the bias for the commodity to extend its rebound phase from the USD49.41 low. Towards the upside, a firm breach above the immediate resistance should enhance the case for a deeper rebound to develop. This rebound was triggered after the WTI Crude experienced steep retracement between early October and endNovember, which sent its daily RSI into an oversold threshold. Based on these, we keep our positive trading bias.

As we do not see signs for the steep retracement – since 3 Oct’s USD76.90 high – to resume anytime soon, we continue to recommend that traders maintain long positions. We initiated these positions at USD52.95, or the closing level of 3 Dec. For risk-management purposes, a stop-loss can be placed at below the USD49.41 level.

Immediate support is pegged at USD49.41, the low of 29 Nov. The second support is eyed at the USD45.58 threshold, which was the low of 31 Aug 2017. On the other hand, immediate resistance is expected at the USD54.12 mark, ie the high of 23 Nov. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 7 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024