WTI Crude Futures - Looking for Further Bounce

rhboskres

Publish date: Mon, 10 Dec 2018, 09:05 AM

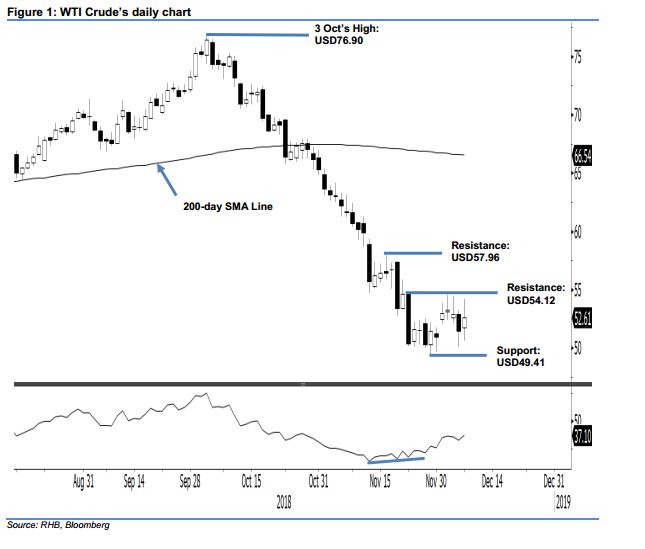

Maintain long positions as the commodity is still looking to bounce higher. The WTI Crude formed a white candle in the latest session to close at USD52.61 – a gain of USD1.12. This was after, intraday, the commodity experienced a wide trading range of between USD50.60 and USD54.22. Broadly, we are still seeing that the commodity is in the initial stage of developing a deeper rebound. This rebound was triggered after it experienced a multi-week sharp retracement between early October and end-November, which sent its daily RSI reading into oversold threshold. Hence, we keep our positive trading bias.

On the bias that the commodity is less likely to resume its multi-week sharp retracement, we continue to recommend that traders maintain long positions. We initiated these positions at USD52.95, or the closing level of 3 Dec. For risk-management purposes, a stop-loss can be placed at below the USD49.41 level.

Towards the downside, immediate support is set at USD49.41, the low of 29 Nov. Breaking this, the market may test the USD45.58 threshold, which was the low of 31 Aug 2017. Conversely, immediate resistance is expected at the USD54.12 mark, ie the high of 23 Nov. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 10 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024