FKLI - Still Bouncing Around

rhboskres

Publish date: Mon, 10 Dec 2018, 09:11 AM

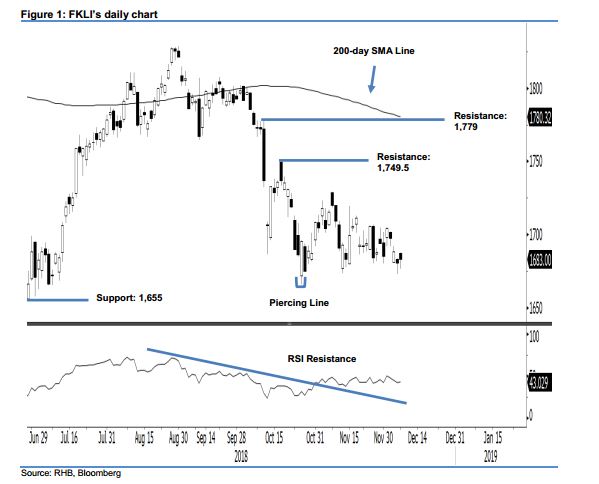

Maintain long positions. Last Friday saw the FKLI ended slightly higher by 2.5 pts at 1,683 pts – after ranging between 1,676.5 pts and 1,687.5 pts. Overall, we maintain the bias that the index is still the process of developing a deeper rebound – which started from the low of the “Piercing Line” formation of 1,665 pts on 25 Oct. As long as the low of the said formation is not breached, the risk for the index’s multi-month retracement returning is considered low. Towards the upside, we are expecting the index to test the immediate resistance of 1,749.5 pts. Hence, we maintain our positive trading bias.

Maintain long positions. Last Friday saw the FKLI ended slightly higher by 2.5 pts at 1,683 pts – after ranging between 1,676.5 pts and 1,687.5 pts. Overall, we maintain the bias that the index is still the process of developing a deeper rebound – which started from the low of the “Piercing Line” formation of 1,665 pts on 25 Oct. As long as the low of the said formation is not breached, the risk for the index’s multi-month retracement returning is considered low. Towards the upside, we are expecting the index to test the immediate resistance of 1,749.5 pts. Hence, we maintain our positive trading bias.

Given our expectation that the index could still extend its rebound to test the said immediate resistance, we recommend that traders stay in long positions, initiated at 1,718 pts, or 2 Nov’s closing level. To manage risks, we stop-loss can be placed at below 1,665 pts, the low of the “Piercing Line”.

The immediate support is at the 1,655-pt level, the low of 28 June, while the second support is at the 1,600-pt mark. Towards the upside, the immediate resistance is now at 1,749.5 pts, or the high of 17 Oct. This is followed by 1,779 pts, the high of 10 Oct.

Source: RHB Securities Research - 10 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024