FCPO - Risk Of New Low Minimal

rhboskres

Publish date: Mon, 10 Dec 2018, 09:12 AM

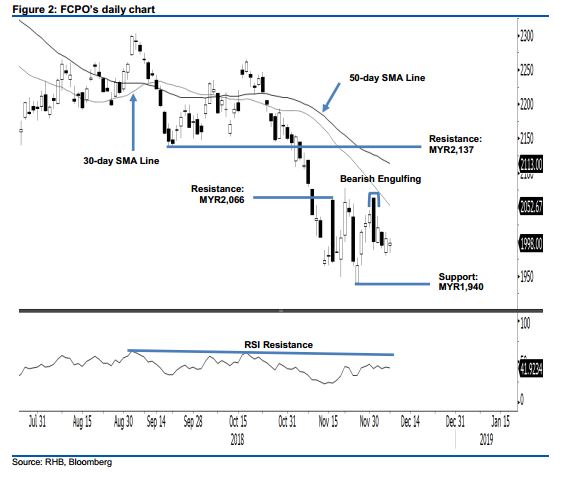

Maintain long positions on the expectation that bulls are still in control of the rebound. The FCPO ended the latest session MYR7 lower at MYR1,998 – this was after it oscillated between a low and high of MYR1,984 and MYR2,005. Looking at the commodity’s price actions over the past week, chances are high that the bulls are taking a breather after the commodity rebounded from the YTD low of MYR1,940 on 27 Nov. This implies that once the breather is completed, the commodity is likely to extend it rebound phase. Towards the upside, the commodity is expected to test both the 30-day and 50-day SMA lines. Based on these, we are keeping to our positive trading bias.

As the commodity is in the early course of developing a deeper rebound, traders should remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed below MYR1,940.

The immediate support is maintained at MYR1,940, the low of 27 Nov. The following support is at MYR1,863, the low of 25 Aug 2015. On the other hand, the immediate resistance is set at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 10 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024