COMEX Gold - the Outlook Remains Positive

rhboskres

Publish date: Tue, 11 Dec 2018, 08:51 AM

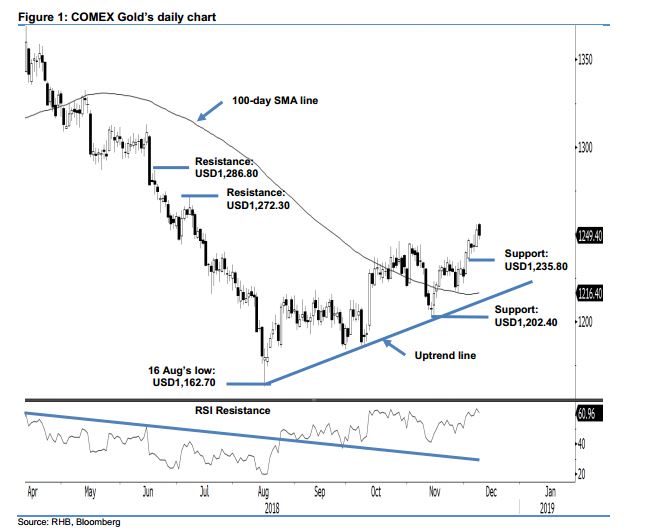

Maintain long positions, as the bulls are probably taking a breather. The COMEX Gold formed a black candle in the latest session, after it failed to sustain the early session’s positive momentum. For the intraday, the precious metal posted a low and high of USD1,246.90 and USD1,256.60, before closing at USD1,249.40, indicating a decline of USD3.20. As of now, we are not seeing the intraday reversal as an initial sign that its uptrend – that started from the low of USD1,162.70 on 16 Aug – has reached to an end. Instead, it is more likely a minor breather after the recent upward move. The daily RSI reading of 60.96 also suggests room for further positive moves. Consequently, we keep our positive trading bias.

As there are no negative price signals to threaten the COMEX Gold’s positive price trend, we continue to recommend traders to keep to long positions at the USD1,216 mark. This was 14 Nov’s closing level. For riskmanagement purposes, a stop-loss can be placed below the USD1,235.80 threshold.

Towards the downside, the immediate support is set at USD1,235.80, which was the low of 4 Dec. The following support may appear at USD1,202.40, or the low of 13 Nov. Conversely, the immediate resistance is set at USD1,272.30, or the high of 9 Jul. This is followed by USD1,286.80, ie the high of 19 Jun.

Source: RHB Securities Research - 11 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024