WTI Crude Futures - Looking for Further Bounce

rhboskres

Publish date: Tue, 11 Dec 2018, 08:55 AM

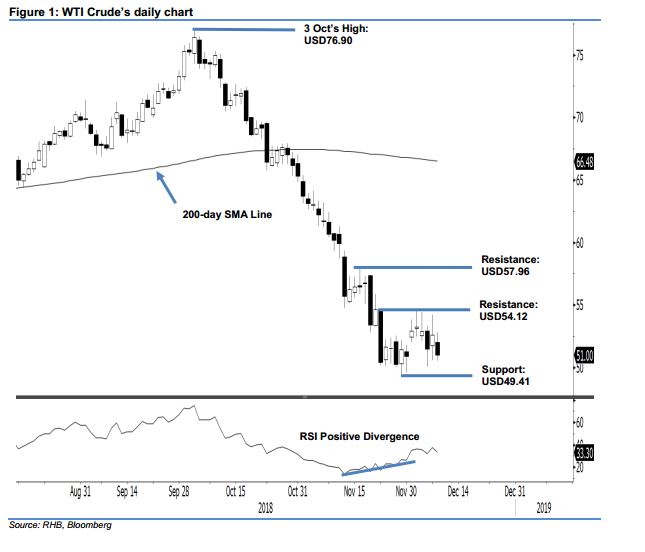

Maintain long positions, provided the immediate support holds. The WTI Crude formed a black candle in the latest trade – easing USD1.61 to settle at USD51. The intraday tone was discouraging, as the commodity generally moved lower for the whole session, with the high and low recorded at USD52.81 and USD50.53. Nevertheless, the validity for the WTI Crude to extend its rebound, which started from the low of USD49.41 on 29 Nov, should still be in place – provided the said low is not breached. This rebound phase was triggered after the commodity experienced a sharp multi-week retracement between early October and end November. As a result, we keep our positive trading bias.

As we see the risk for the WTI Crude’s multi-week sharp retracement returning as low at this juncture, we continue to recommend that traders maintain long positions. We initiated these positions at USD52.95, or the closing level of 3 Dec. For risk-management purposes, a stop-loss can be placed below the USD49.41 level.

Immediate support is maintained at the aforementioned USD49.41, ie the low of 29 Nov. The following support is eyed at the USD45.58 threshold, which was the low of 31 Aug 2017. Moving up, immediate resistance is expected at the USD54.12 mark, ie the high of 23 Nov. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 11 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024