FKLI - Coming to Test YTD Low

rhboskres

Publish date: Tue, 11 Dec 2018, 08:57 AM

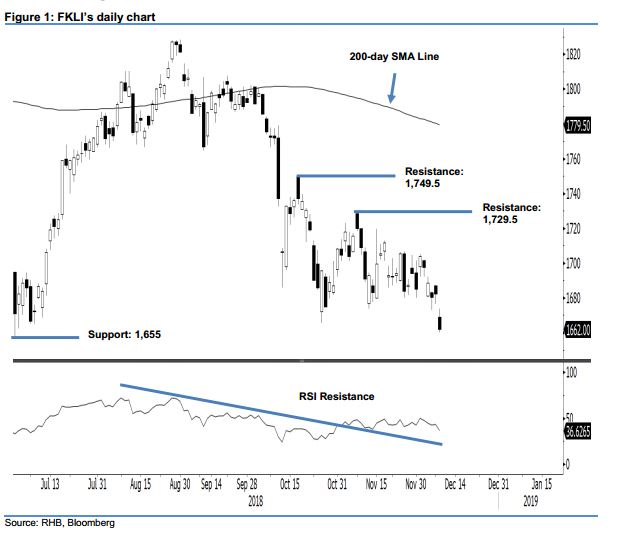

Initiate short positions on rising risk of the multi-month retracement returning. The FKLI formed a black candle in the latest session and at the closing breached below the low of the 25 Oct’s “Piercing Line” formation. The session’s low and high were recorded at 1,660 pts and 1,673.5 pts, before the index ended 19.5 pts weaker at 1,662 pts. The failure of the “Piercing Line” to hold suggests our previous bias for the index to extend its rebound phase has been invalidated. This also means the risk is now higher for the index’s multi-month retracement to resume. Towards the downside a firm breach of the immediate support of 1,655 pts would likely confirm the resumption of the said downtrend. Hence, we switch our trading bias to negative.

Our previous long positions initiated at 1,718 pts, or 2 Nov closing level, were closed out yesterday at 1,665 pts, the low of the “Piercing Line”. On the higher chance that the index may resume its multi-month retracement, we initiate short positions at the latest closing. A stop-loss can be placed at above 1,687.5 pts.

The immediate support is still pegged at the 1,655-pt level, the low of 28 Jun. This is followed by the 1,600-pt mark. Moving up, the immediate resistance is now at 1,729 pts, the high of 8 Nov. This is followed by 1,749.5 pts, or the high of 17 Oct.

Source: RHB Securities Research - 11 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024