FCPO - Rebound May Resume

rhboskres

Publish date: Tue, 11 Dec 2018, 08:58 AM

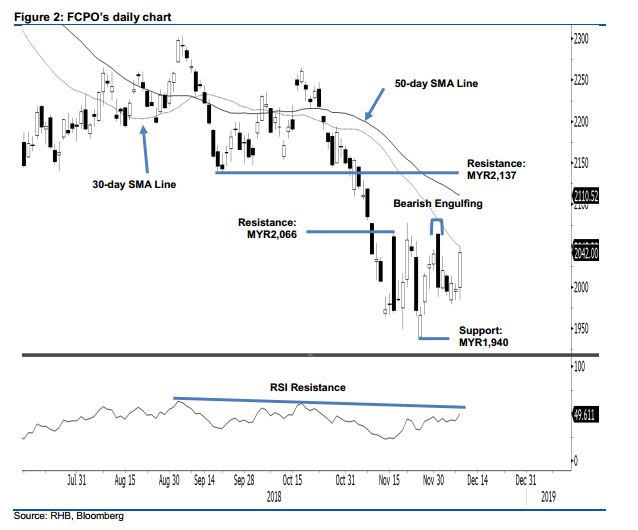

Maintain long positions as the consolidation phase may have ended. The FCPO formed a long white candle in the latest session to settle MYR44 higher at MYR2,042. Intraday tone was encouraging as the commodity generally trended higher with the low and high recorded at MYR1,985 and MYR2,049. The relative strong performance came after the commodity was in a consolidation mode the previous week – this may signal the end of the said consolidation phase and that it is now likely to resume its rebound. Towards the upside, we are expecting both the 30-day and 50-day SMA lines to be tested. Hence, we are keeping to our positive trading bias.

As the latest strong session likely marked the end of the one week consolidation, with commodity likely to extend its rebound phase from here, traders should remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed below MYR1,940.

Towards the downside, the immediate support is expected at MYR1,940, the low of 27 Nov. This is followed by MYR1,863, the low of 25 Aug 2015. Conversely, the immediate resistance is set at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep.

Source: RHB Securities Research - 11 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024