E-mini Dow Futures - Bearish Prospects

rhboskres

Publish date: Wed, 12 Dec 2018, 04:26 PM

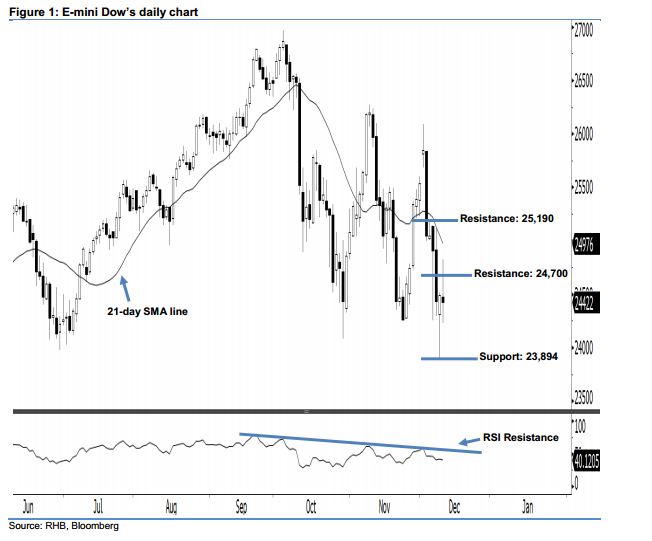

Stay short provided that the 24,700-pt resistance is not violated at the close. The E-mini Dow formed a black candle yesterday. It closed at 24,422 pts, off its high of 24,823 pts and low of 24,231 pts. On a technical basis, we maintain our bearish sentiment, as the index is still trading below the declining 21-day SMA line. Given that the previously-indicated 24,700-pt resistance was not violated at the close, this shows the downside momentum has not diminished yet. Furthermore, the 14-day RSI indicator is not dropping to a more bearish reading of 40.12 pts, which suggests the bearish sentiment has been enhanced.

As seen in the chart, we anticipate the immediate resistance at 24,700 pts, set near the midpoint of 7 Dec’s long black candle. Meanwhile, the next resistance is maintained at 25,190 pts, which was the high of 5 Dec. To the downside, we eye the immediate support at 23,894 pts – this was determined from the low of 10 Dec. If a decisive breakdown occurs, look to 23,467 pts – ie the previous low of 3 May – as the next support.

Therefore, we advise traders to stay short, following our recommendation of initiating short below the 25,500-pt level on 5 Dec. At the same time, a trailing-stop can be set above the 24,700-pt threshold to secure part of the gains.

Source: RHB Securities Research - 12 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024