COMEX Gold - the Outlook Remains Positive

rhboskres

Publish date: Wed, 12 Dec 2018, 04:29 PM

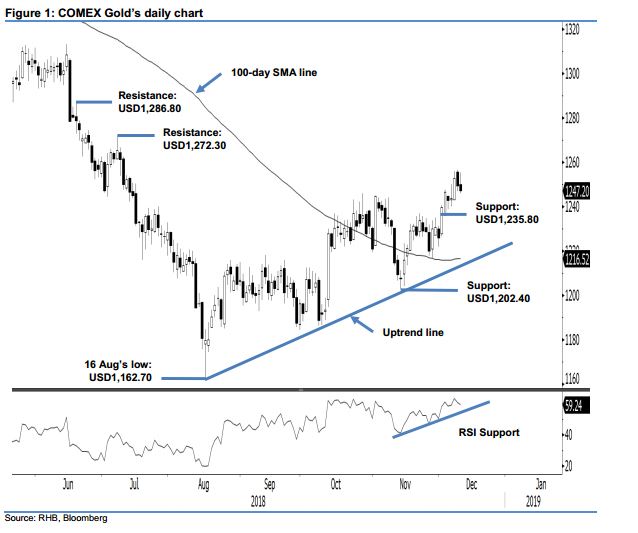

Maintain long positions. The COMEX Gold performed weakly in the latest session as it eased USD2.20 to end at USD1,247.20. Intraday tone was also negative, as it generally moved lower throughout the session, with the high and low registered at USD1,255.10 and USD1,245.80. Broadly, the latest weak sessions are still not flashing out a price reversal signal – instead we are seeing it as a sign of a minor consolidation phase after the commodity breached above the previous immediate resistance of USD1,246. The 100-day SMA line, which is starting to show early signs of turning up, is also lending further support to the positive bias. Based on these, we keep our positive trading bias.

As the bias is still tiled towards the extension of the upward move since the low of USD1,162.70 that started from 16 Aug, we continue to recommend traders keep to long positions at the USD1,216 mark. This was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,235.80 threshold.

Immediate support is maintained at USD1,235.80, which was the low of 4 Dec. This is to be followed by USD1,202.40, or the low of 13 Nov. On the other hand, the immediate resistance is set at USD1,272.30, or the high of 9 Jul. This is followed by USD1,286.80, ie the high of 19 Jun

Source: RHB Securities Research - 12 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024