FKLI - Immediate Support Gives Way

rhboskres

Publish date: Wed, 12 Dec 2018, 04:30 PM

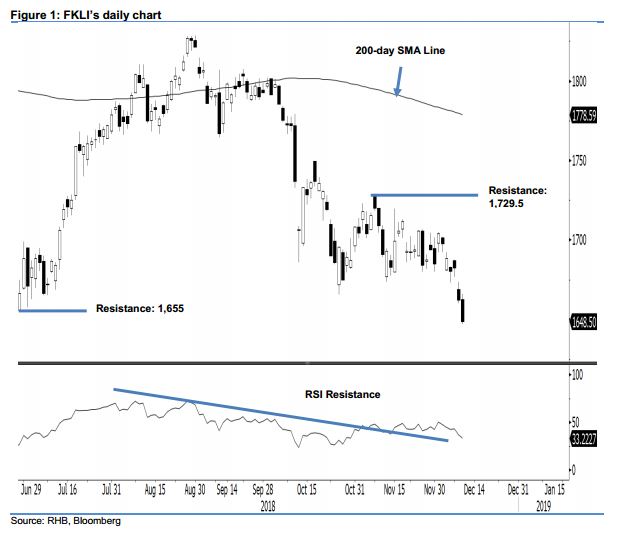

Maintain short positions as the previous immediate support is breached. The FKLI formed a black candle in the latest trading session and at the closing, breached the previous YTD low of 1,655 pts – this suggests its multimonth retracement is extending, after the recent rebound. Intraday tone was negative, as the index trended lower throughout the session – the high and low were posted at 1,647 pts and 1,666 pts, before closing 13.5 pts lower at 1,648.5 pts. As the bears are re-asserting control over the price trend, and with the daily RSI reading of 32.22 indicating a weak momentum, we keep to our negative trading bias.

As the breakdown from the said previous immediate support is enhancing the negative bias, we continue to recommend that traders keep to short positions, which we initiated at 1,662 pts, or the closing level of 11 Nov. A stop-loss can now be placed at the breakeven level.

We revise the immediate support to 1,600-pt mark, a round figure. This followed by 1,579 pts, the low of 29 Sep 2015. Towards the upside, the immediate resistance is now eyed at the 1,655-pt level, the low of 28 Jun. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 12 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024