COMEX Gold - Trend Is Constructive

rhboskres

Publish date: Thu, 13 Dec 2018, 04:42 PM

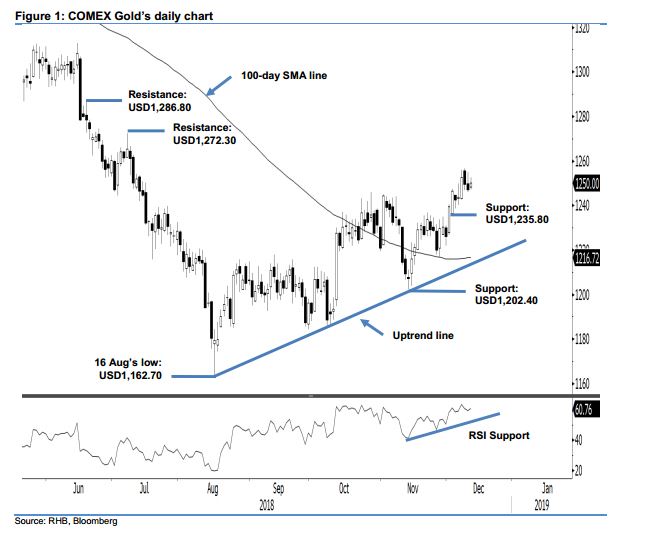

Maintain long positions as the positive trend is showing signs of extending. The COMEX Gold ended the latest session slightly better. It settled USD2.80 higher at USD1,250, the daily trading range was relatively narrow and between USD1,247.10 and USD1,252.60. Despite the latest slight positive performance, we continue to see it as part of the ongoing minor consolidation phase that has been taking place over the latest three sessions. This consolidation phase kicked in after the commodity breached above the previous resistance of USD1,246. On these technicalities, we keep our positive trading bias.

As there are no price signals to suggest exhaustion to the commodity’s price trend, we continue to recommend traders keep to long positions at the USD1,216 mark. This was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,235.80 threshold.

Towards the downside, immediate support is pegged at USD1,235.80, which was the low of 4 Dec. The second support is at USD1,202.40, or the low of 13 Nov. Moving up, the immediate resistance is set at USD1,272.30, or the high of 9 Jul. This is followed by USD1,286.80, ie the high of 19 Jun.

Source: RHB Securities Research - 13 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024