FKLI - Back Above the Immediate Resistance

rhboskres

Publish date: Thu, 13 Dec 2018, 04:43 PM

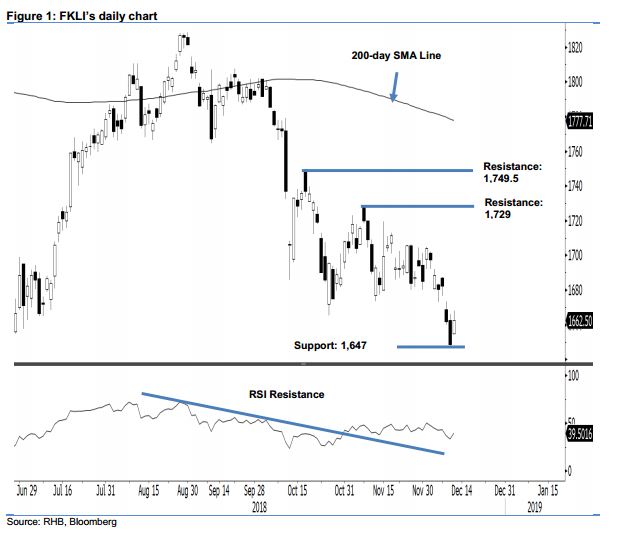

Initiate long positions on possible false breakdown. The FKLI formed a white candle in the latest session, and at the closing, managed to recapture the previous crucial support-turned-resistance level of 1,655 pts. Intraday tone was positive, as the index scaled higher with the low and high at 1,654.5 pts and 1,668 pts, before closing 14 pts up at 1,662.5 pts. The recapturing of the said support-turned-resistance may suggest that the previous breakdown from the said level in the prior session was not valid. This implies, there is a good chance of the index rebounding further in the coming sessions. Based on this, we switch our trading bias to positive.

Our previous short positions, which we initiated at 1,662 pts or the closing level of 11 Nov, were closed out at the breakeven level yesterday. As the index is signalling a possible rebound, we initiate long positions at the latest closing. For risk management purposes, a stop loss can be placed at below 1,647 pts.

We revise the immediate support to 1,647 pts, the low of 11 Nov. This is followed by the 1,600-pt mark, a round figure. Moving up, the immediate resistance is expected at 1,729 pts, the high of 8 Nov. The second resistance is set at 1,749.5 pts, the high of 17 Oct.

Source: RHB Securities Research - 13 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024