E-mini Dow Futures - Selling Momentum Pause to Digest

rhboskres

Publish date: Fri, 14 Dec 2018, 04:22 PM

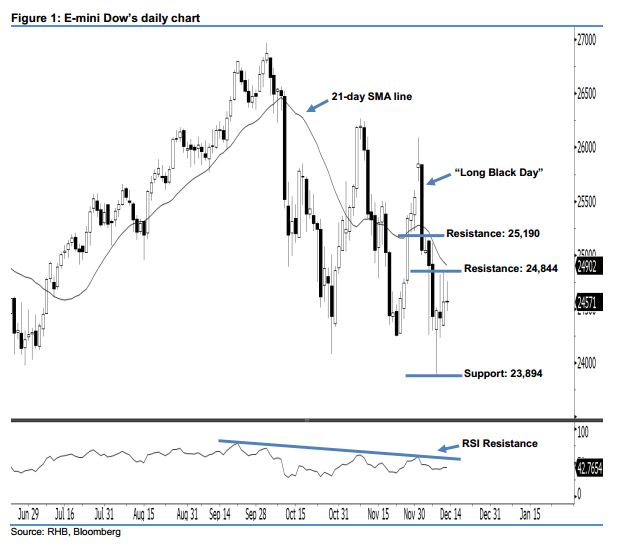

Bearish outlook remains unchanged; maintain short positions. The E-mini Dow formed a “Doji” candle last night. It settled at 24,571 pts, after hovering between a high of 24,753 pts and low of 24,481 pts throughout the day. However, the appearance of yesterday’s “Doji” candle indicates that sellers may be taking a pause after the recent losses. As the index is still trading below the declining 21-day SMA line, this implies that the bearish sentiment stays intact. Overall, we think the downside swing – which started from 4 Dec’s “Long Black Day” candle – may persist.

Presently, we anticipate the immediate resistance level at 24,844 pts, set at the high of 12 Dec. The next resistance would likely be at 25,190 pts, which was the high of 5 Dec. To the downside, we maintain the immediate support level at 23,894 pts, determined from the previous low of 10 Dec. If a decisive breakdown arises, look to 23,467 pts – ie the previous low of 3 May – as the next support.

Thus, we advise traders to maintain short positions, following our recommendation of initiating short below the 25,500-pt level on 5 Dec. For now, a new trailing-stop is preferably set above the 24,844-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 14 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024