WTI Crude Futures - Still Looks Like a Small Rebound

rhboskres

Publish date: Fri, 14 Dec 2018, 04:23 PM

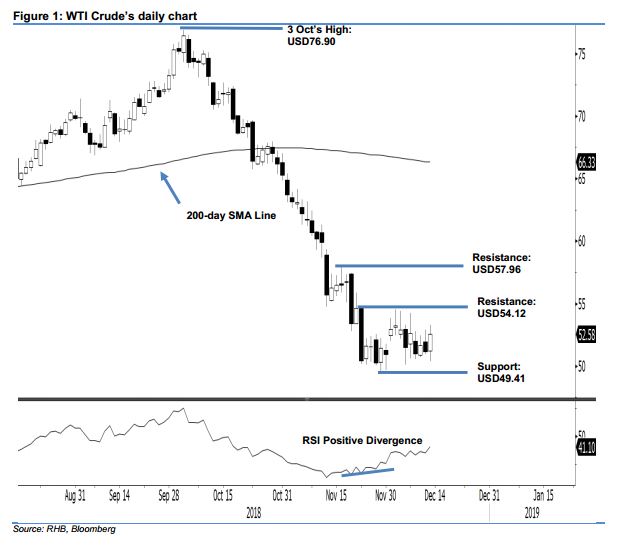

Maintain long positions. The WTI Crude formed a white candle in the latest trading session to end USD1.43 higher at USD52.58. The intraday trading range was wide, between USD50.35 and USD 53.27. Broadly, while the commodity is rebounding as expected, this ongoing rebound since the low of USD49.41 on 29 Nov is still considered narrow relative to the sharp retracement of between early October and end-November. For a bigger rebound to develop, the commodity needs to clear the overhead resistance of USD54.12. Towards the downside, the risk for the declining trend to resume is low, provided the USD49.41 mark is not breached. Based on this, we are keeping our positive trading bias.

With no signal to suggest the rebound has reached an end, we continue to recommend that traders maintain long positions. We initiated these positions at USD52.95, or the closing level of 3 Dec. For risk-management purposes, a stop-loss can be placed below the USD49.41 level.

Towards the downside, immediate support is set at USD49.41, ie the low of 29 Nov. The second support is at the USD45.58 threshold, which was the low of 31 Aug 2017. Moving up, immediate resistance is set at the USD54.12 mark, ie the high of 23 Nov. This is followed by USD57.96, or the high of 16 Nov.

Source: RHB Securities Research - 14 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024