FCPO - Bulls Testing The Immediate Resistance

rhboskres

Publish date: Fri, 14 Dec 2018, 04:26 PM

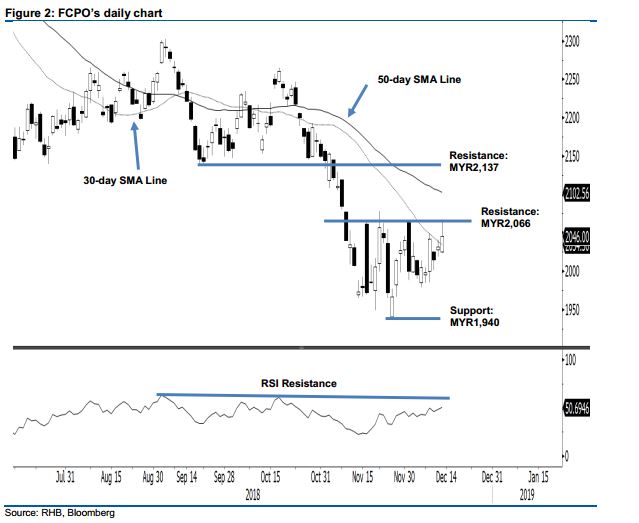

Maintain long positions as rebound is still in play. The FCPO performed positively in the latest session – at one point it tested the immediate resistance of MYR2,066. The session’s low and high were at MYR2,023 and MYR2,067, before it ending MYR14 higher at MYR2,046. While the commodity is still unable to close above the said immediate resistance, we are not seeing it as a sign of total price reversal at this juncture. This implies the overall bias for the commodity to extend its rebound is still in place. We continue to expect this commodity’s ongoing rebound to test the 50-day SMA line. Based on this, we keep to our positive trading bias.

With the commodity still showing positive momentum to challenge the said immediate resistance, traders are advised to remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed below MYR1,940.

Towards the downside, the immediate support is still pegged at MYR1,940, the low of 27 Nov. This is to be followed by MYR1,863, the low of 25 Aug 2015. Conversely, the immediate resistance is set at MYR2,066, the high of 16 Nov. This is followed by MYR2,137, the low of 20 Sep

Source: RHB Securities Research - 14 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024