FCPO - Bulls In Control

rhboskres

Publish date: Mon, 17 Dec 2018, 09:32 AM

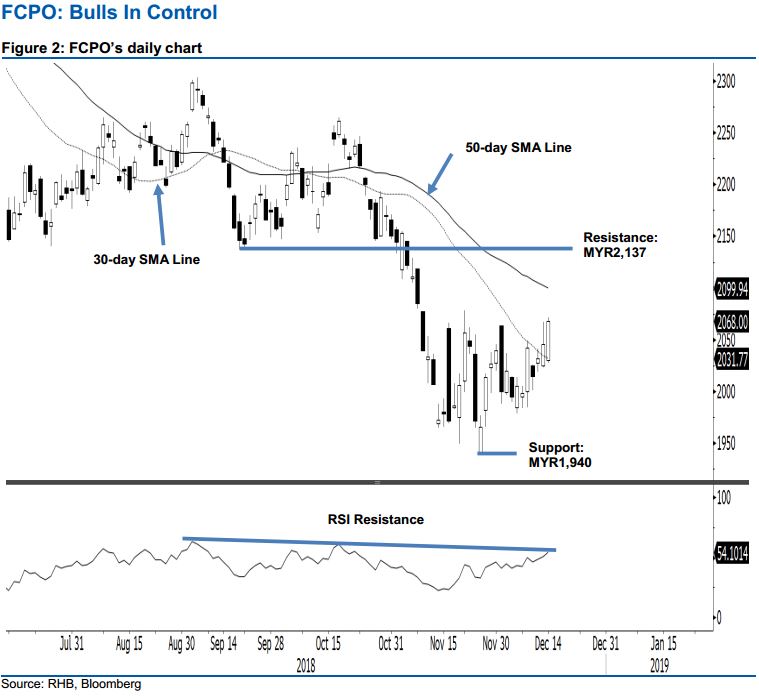

Maintain long positions to catch the rebound. The FCPO ended the latest session on a positive note. It closed MYR22 higher to settle at MYR2,068, thus crossing the previous immediate resistance of MYR2,066. The session’s low and high were at MYR2,028 and MYR2,071. The upside breach of the said previous immediate resistance is lending further support to our bias that the commodity is developing a deeper rebound. The daily RSI is also suggesting that the rebound so far is still not stretched. On these technicalities, we keep to our positive trading bias.

As the rebound continues to show sign of progress without flashing out price exhaustion signals, traders are advised to remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed below MYR1,940.

The immediate support is expected at MYR1,940, the low of 27 Nov. The second support is at MYR1,863, the low of 25 Aug 2015. On the other hand, the immediate resistance is revised to MYR2,137, the low of 20 Sep. This is followed by MYR2,000, a round figure.

Source: RHB Securities Research - 17 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024