E-mini Dow Futures - Downward Momentum Resumes

rhboskres

Publish date: Mon, 17 Dec 2018, 10:05 AM

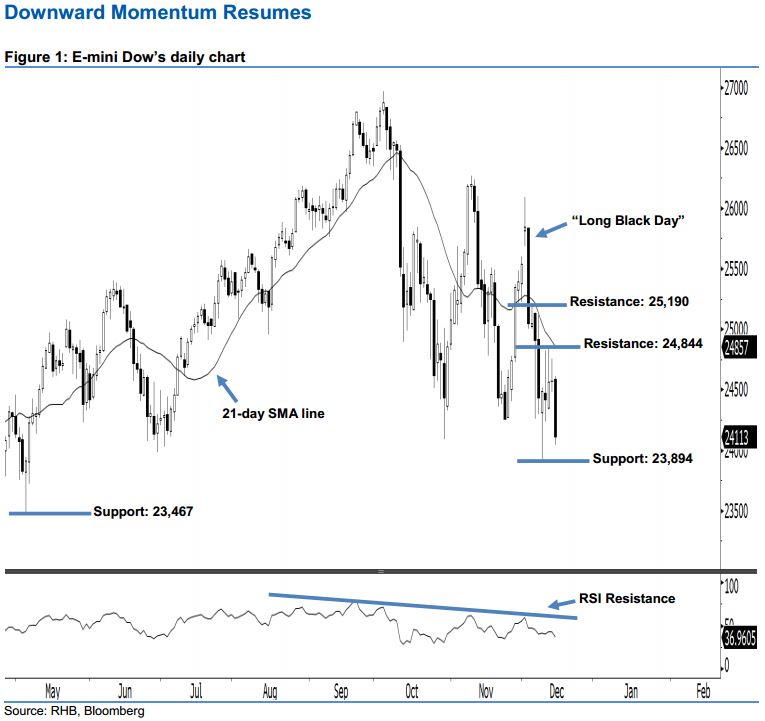

Stay short, with a trailing-stop set above the 24,844-pt resistance. The selling momentum in the E-mini Dow continued as expected. A long black candle was formed last Friday, which pointed towards a continuation of the downside move. It plunged 458 pts to close at 24,113 pts. As the index has erased the previous week’s gains and marked a lower close below the 21-day SMA line, this indicates that the downside momentum is likely to continue. Overall, we expect the market to decline further if the immediate 23,894-pt support mentioned previously is taken out decisively in the coming sessions.

As seen in the chart, we are eyeing the immediate resistance level at 24,844 pts, ie the high of 12 Dec. If a breakout arises, look to 25,190 pts – determined from the high of 5 Dec – as the next resistance. Towards the downside, the immediate support level is seen at 23,894 pts, which was the previous low of 10 Dec, Meanwhile, the next support is maintained at 23,467 pts, defined from the low of 3 May.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 25,500-pt level on 5 Dec. A trailing-stop can be set above the 24,844-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 17 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024