Hang Seng Index Futures - Stick to Long Positions

rhboskres

Publish date: Tue, 18 Dec 2018, 09:39 AM

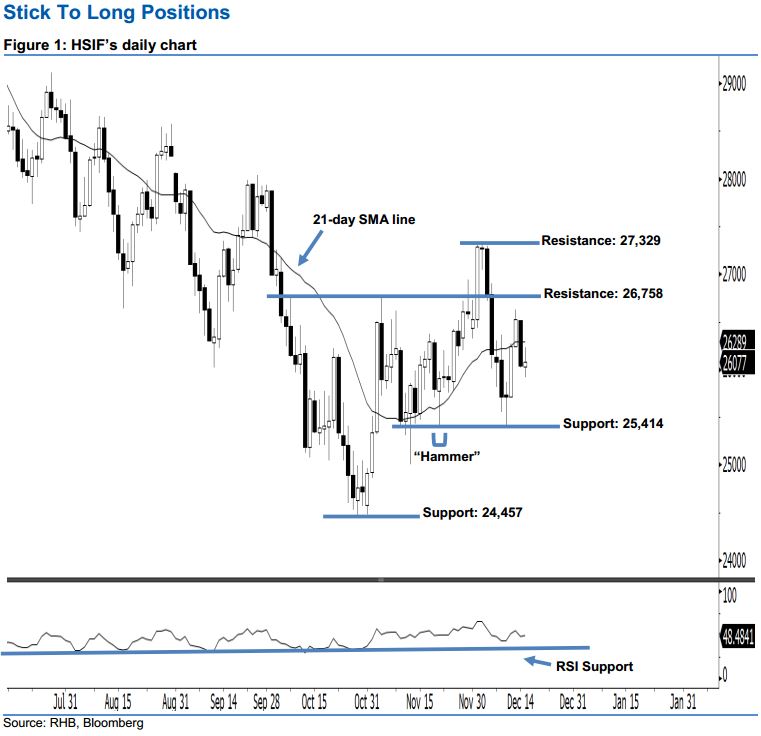

Upside move is not diminished yet; maintain long positions. The HSIF formed a positive candle yesterday. It settled at 26,077 pts, off its high of 26,231 pts and low of 25,920 pts. However, we maintain our positive view, as the index is still trading above the previously-indicated 25,414-pt support. Again, from a technical perspective, as long as the bullishness of the “Hammer” pattern formed on 21 Nov is not nullified, we believe that the bullish sentiment would stay intact.

Judging from the current outlook, we anticipate the immediate support level at 25,414 pts, determined from the low of 21 Nov’s “Hammer” pattern. If this level is taken out, look to 24,457 pts - ie the previous low of 29 Oct – as the next support. On the other hand, the immediate resistance level is seen at 26,758 pts, which was near the highs of 8 Oct and 5 Nov. The next resistance would likely be at 27,329 pts, ie the high of 4 Dec.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 25,900-pt level on 5 Nov. A trailing-stop can be set below the 25,414-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 18 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024