E-mini Dow Futures - Selling Pressure Continues

rhboskres

Publish date: Tue, 18 Dec 2018, 09:41 AM

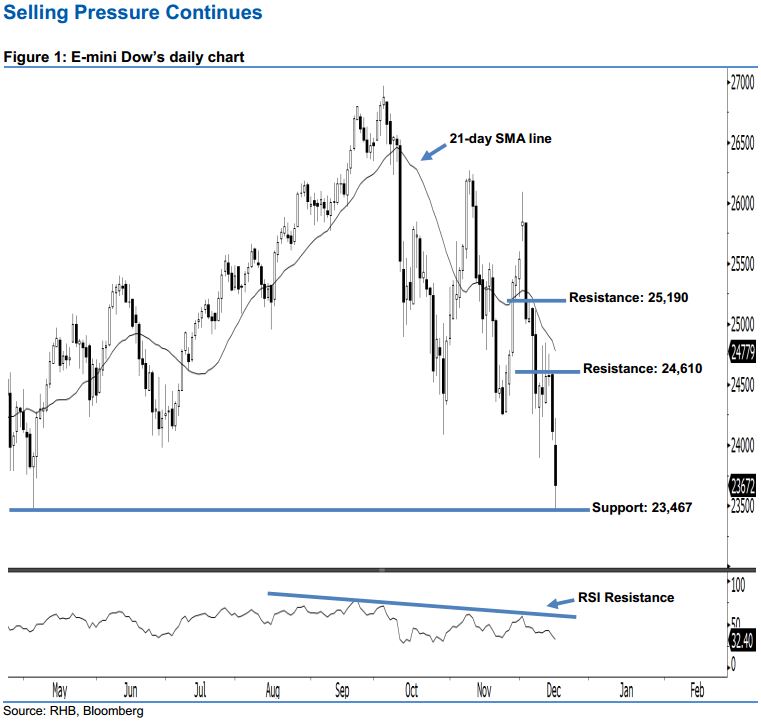

Stay short while setting a new trailing-stop above the 24,610-pt resistance. Last night, the E-mini Dow’s downward momentum continued as expected, after it successfully ended lower to form another black candle. It lost 441 pts to close at 23,672 pts, off the session’s high of 24,226 pts. As the index has breached below the 23,894-pt support mentioned previously, this can be viewed as the bears extending their selling momentum. In view of the fact that the E-mini Dow has marked the lowest point in more than eight months, this is an indication that the downside swing that started off 4 Dec’s long black candle may persist.

According to the daily chart, the immediate resistance level is now seen at 24,610 pts, which was the high of 14 Dec. The next resistance would likely be at 25,190 pts, ie the high of 5 Dec. To the downside, we are eyeing the immediate support level at 23,467 pts, obtained from the low of 3 May. If this level is taken out decisively, the next support is seen at 23,000-pt psychological spot.

To re-cap, on 5 Dec, we initially recommended traders to initiate short positions below the 25,500-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 24,610-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 18 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024