E-mini Dow Futures - Persistent Downward Momentum

rhboskres

Publish date: Wed, 19 Dec 2018, 05:38 PM

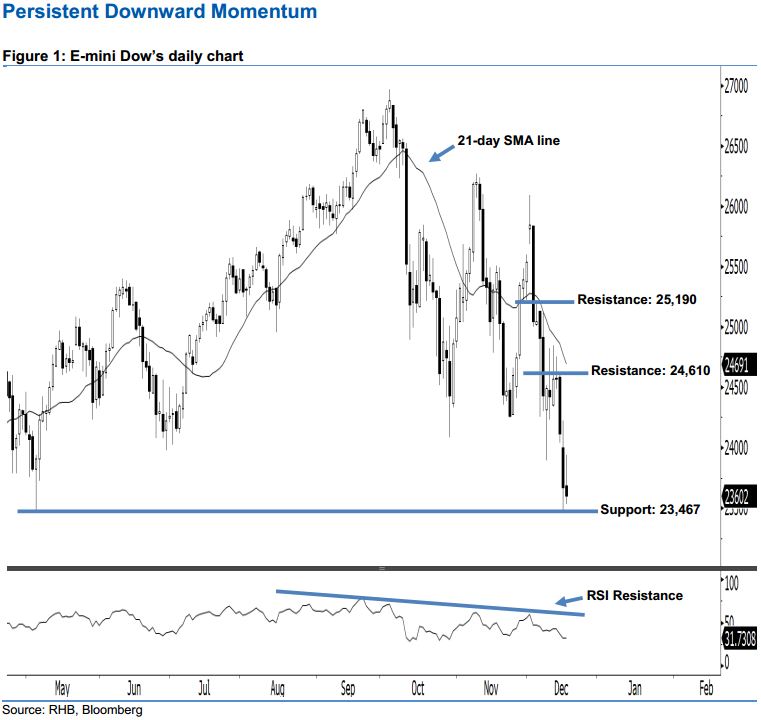

Stay short. The E-mini Dow’s downside momentum continued as expected after it ended lower and formed a black candle with a long upper shadow yesterday. It dropped 70 pts to close at 23,602 pts, after oscillating between a high of 23,939 pts and low of 23,528 pts. Technically, investor sentiment remains bearish, given that the index has marked a lower close vis-à-vis the previous sessions since 14 Dec. Meanwhile, yesterday’s long upper shadow shows that there was buying momentum during the day before the market pushed it down by the end of the trading session. This suggests that the sellers still have control of the market.

As seen in the chart, we are eyeing the immediate resistance level at 24,610 pts, ie the high of 14 Dec. The next resistance is seen at 25,190 pts, determined from the high of 5 Dec. Towards the downside, we anticipate the immediate support level at 23,467 pts, which was the low of 3 May. If a decisive breakdown arises, the next support is maintained at the 23,000-pt psychological spot.

Hence, we advise traders to stay short, since we had originally recommended initiating short below the 25,500-pt level on 5 Dec. In the meantime, a trailing-stop can be set above the 24,610-pt threshold in order to secure part of the profits.

Source: RHB Securities Research - 19 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024