E-mini Dow Futures - Charts Another Black Candle

rhboskres

Publish date: Thu, 20 Dec 2018, 08:56 AM

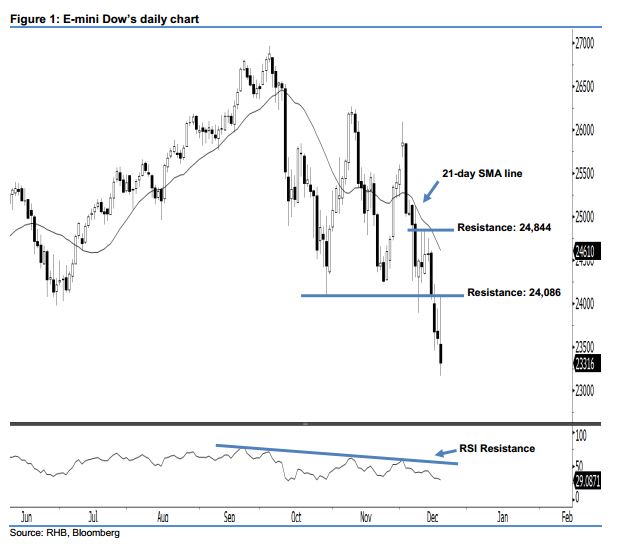

Stay short while setting a new trailing-stop above the 24,086-pt level. The selling momentum of the E-mini Dow continued as expected, as a black candle was formed last night. It lost 286 pts to settle at 23,316 pts, off the session’s high of 24,086 pts. As the E-mini Dow has taken out the 23,467-pt support mentioned previously, this can be viewed as the bears expanding their downward momentum. In view of the fact that the index has posted a black candle for the fourth consecutive session, this indicates that the downside swing that started off 4 Dec’s long black candle may go on.

Based on the daily chart, we now anticipate the immediate resistance level at 24,086 pts, situated at the high of 19 Dec. The next resistance would likely be at 24,844 pts, obtained from the high of 12 Dec. To the downside, we are now eyeing the immediate support level at the 23,000-pt psychological mark. If the price breaks down, look to 22,174 pts – which was the previous low of 25 Sep 2017 – as the next support.

Recall that on 5 Dec, we initially recommended traders to initiate short positions below the 25,500-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 24,086-pt threshold in order to lock in a larger part of the profits.

Source: RHB Securities Research - 20 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024