COMEX Gold - Trend Is Progressing

rhboskres

Publish date: Thu, 20 Dec 2018, 08:59 AM

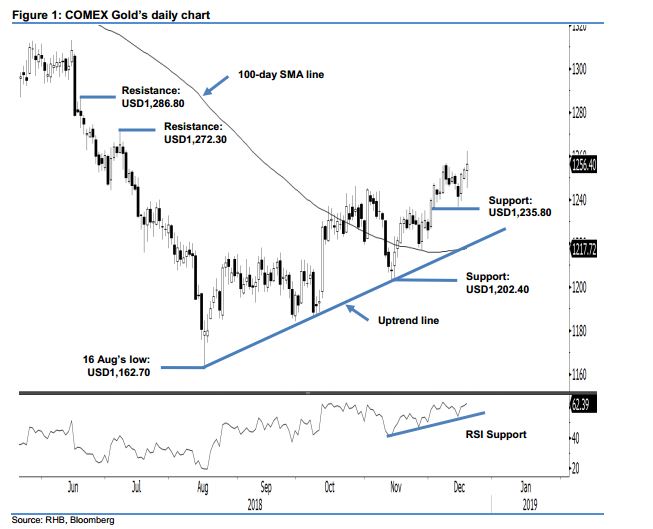

Maintain long positions. The COMEX Gold ended the latest session positively despite the failure to sustain its breakout earlier in the session from the 1.5-week minor consolidation zone – this suggests a possible price rejection. The session’ high and low were posted at USD1,262.20 and USD1,245.30, before it closed USD2.80 higher at USD1,256.40. While the inability to sustain its breakout during the session may suggest that its upward move may have reached an interim top, further price confirmation is needed to arrive at such conclusion. For now, we are looking at the downside break of the latest intraday low to confirm this. Until this happens, we are keeping our positive trading bias.

As we are still awaiting confirmation that the commodity’s upward move has reached an end, we continue to recommend traders to keep to long positions at the USD1,216 mark – this was 14 Nov’s closing level. For riskmanagement purposes, a stop-loss can now be placed below the USD1,245.30 threshold.

Towards the downside, immediate support is still pegged at USD1,235.80, which was the low of 4 Dec. This is followed by USD1,202.40, or the low of 13 Nov. Conversely, the immediate resistance is set at USD1,272.30, or the high of 9 Jul. This is followed by USD1,286.80, ie the high of 19 Jun.

Source: RHB Securities Research - 20 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024