FCPO - Bulls In Control

rhboskres

Publish date: Thu, 20 Dec 2018, 09:02 AM

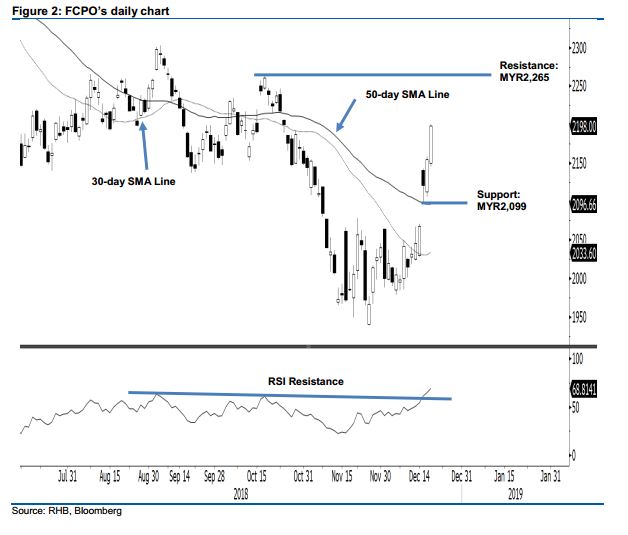

Maintain long positions as the bulls are pressing ahead. The FCPO performed positively in the latest session, and at one point, it tagged the immediate resistance of MYR2,200 – which was also the session’s high, before closing at MYR2,198, indicating a gain of MYR43. The attempt to break the said immediate resistance is lending support to our positive bias on the commodity – which is staging a deeper rebound phase after its steep retracement between January till mid-November. The 30-day SMA line, which has starting to show early signs of reversal, is also supporting the positive bias. Hence, we keep to our positive trading bias.

As the commodity is still showing signs of positive momentum and not flashing an overbought RSI reading, traders are advised to remain in long positions. We initiated these at MYR2,057, or the closing level of 22 Nov. A stop-loss can be placed at below MYR2,099.

The immediate support may appear at MYR2,099, the low of 17 Dec which is also located near the 100-day SMA line. Breaking this may see the commodity test the MYR2,000 mark, a round figure. On the other hand, the immediate resistance is still pegged at MYR2,200, the next round figure. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 20 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024