COMEX Gold - Buyers Are Cheering on

rhboskres

Publish date: Fri, 21 Dec 2018, 04:18 PM

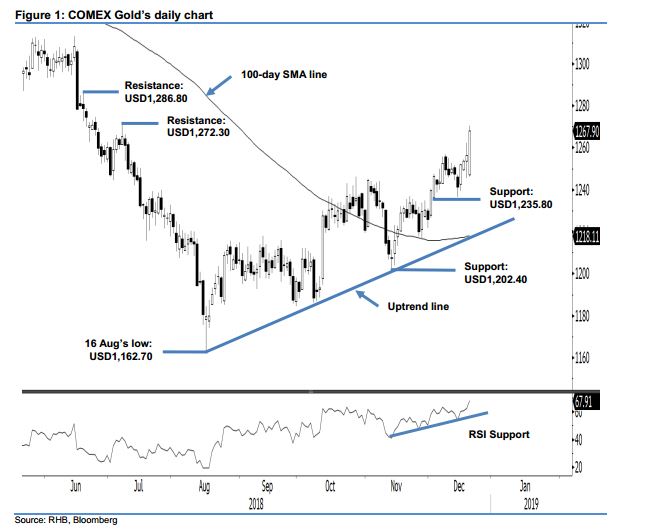

Maintain long positions while keeping trailing-stop tight. The COMEX Gold formed a white candle in the latest session - at the closing, it broke away from its 2-week minor consolidation zone. The session’s low and high were recorded at USD1,246.20 and USD1,270.30, before ending USD11.50 higher at USD1,267.90. The said breakaway signals that the commodity’s positive price trend that started from the low of USD1,162.70 on 16 Aug is still developing. The daily RSI of 67.91 suggests that the uptrend has not reached extreme levels yet. Based on this, we are keeping our positive trading bias.

With all signs pointing towards the uptrend still intact, we continue to recommend traders to keep to long positions at the USD1,216 mark – this was 14 Nov’s closing level. For risk-management purposes, a stop-loss can be placed below the USD1,245.30 threshold.

Immediate support is still expected at USD1,235.80, which was the low of 4 Dec. This is followed by USD1,202.40, or the low of 13 Nov. On the other hand, the immediate resistance is set at USD1,272.30, or the high of 9 Jul. This is followed by USD1,286.80, ie the high of 19 Jun.

Source: RHB Securities Research - 21 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024