WTI Crude Futures - Bulls in Holiday Mood

rhboskres

Publish date: Fri, 21 Dec 2018, 04:23 PM

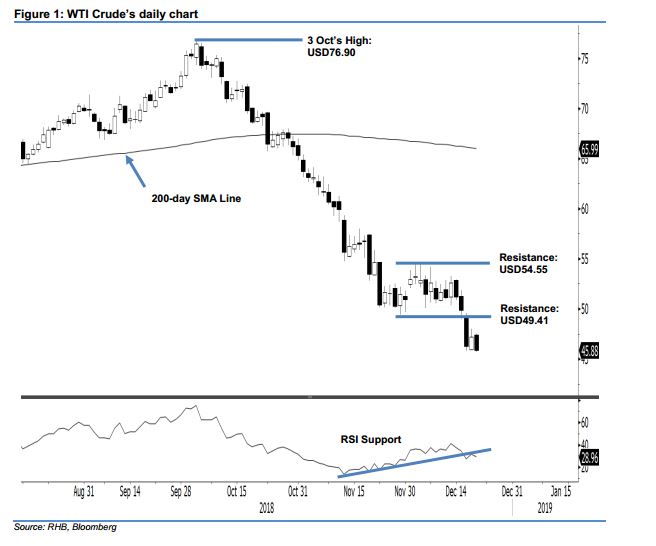

Maintain short positions as the bulls are still not able to reverse negative trend. The WTI Crude formed a black candle in the latest session, easing USD1.32 to USD45.88. The intraday tone was discouraging as it generally slid lower for most of the session – high and low were posted at USD47.51 and USD45.67. The negative session indicates that the multi-week negative price trend is continuing to develop. While the daily RSI is flashing out an oversold reading, positive price confirmation is needed to suggest that the said multi-week deep retracement has in fact reached an end – we are looking for an upside breach of the USD49.41 immediate resistance. Until this happens, we keep to our negative trading tone.

With the negative trend not showing signs of ending, we continue to recommend traders to keep to short positions that were initiated at USD46.14, the closing level of 19 Dec. A stop-loss can be placed above USD49.41.

Immediate support may emerge at the USD45.58 threshold, which was the low of 31 Aug 2017. This is followed by USD43.65, the low of 10 Jul. Conversely, immediate resistance is expected at USD49.41, ie the low of 29 Nov. This is followed by USD54.55, the high of 4 Dec.

Source: RHB Securities Research - 21 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024