Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Wed, 26 Dec 2018, 04:54 PM

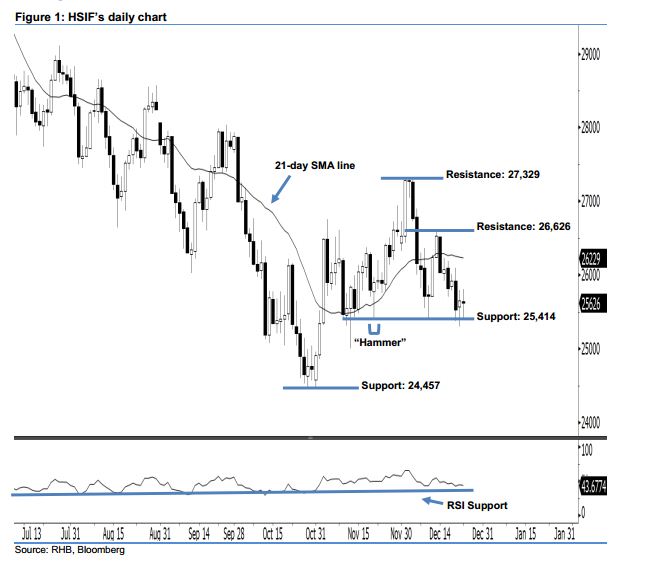

Rebound is not diminished yet; maintain long positions. The HSIF formed a “Doji” candle on Monday. It closed at 25,626 pts, after hovering between a high of 25,806 pts and low of 25,400 pts. Yet, we maintain our positive sentiment, as the HSIF is still trading above the previously-indicated 25,414-pt support. From a technical perspective, as long as the index does not negate the bullishness of the “Hammer” pattern created by 21 Nov, we believe that buyers still have control over the market. Overall, we stay positive on the HSIF’s outlook.

As seen in the chart, the immediate support level is seen at 25,414 pts, which was the low of 21 Nov’s “Hammer” pattern. If a decisive breakdown arises, look to 24,457 pts – determined from the previous low of 29 Oct – as the next support. On the other hand, we are eyeing the immediate resistance level at 26,626 pts, ie the high of 13 Dec. Meanwhile, the next resistance is maintained at 27,329 pts, situated at the high of 4 Dec.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 25,900-pt level on 5 Nov. At the same time, a trailing-stop is preferably set below the 25,414-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 26 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024