FCPO - Still Negative

rhboskres

Publish date: Mon, 31 Dec 2018, 09:29 AM

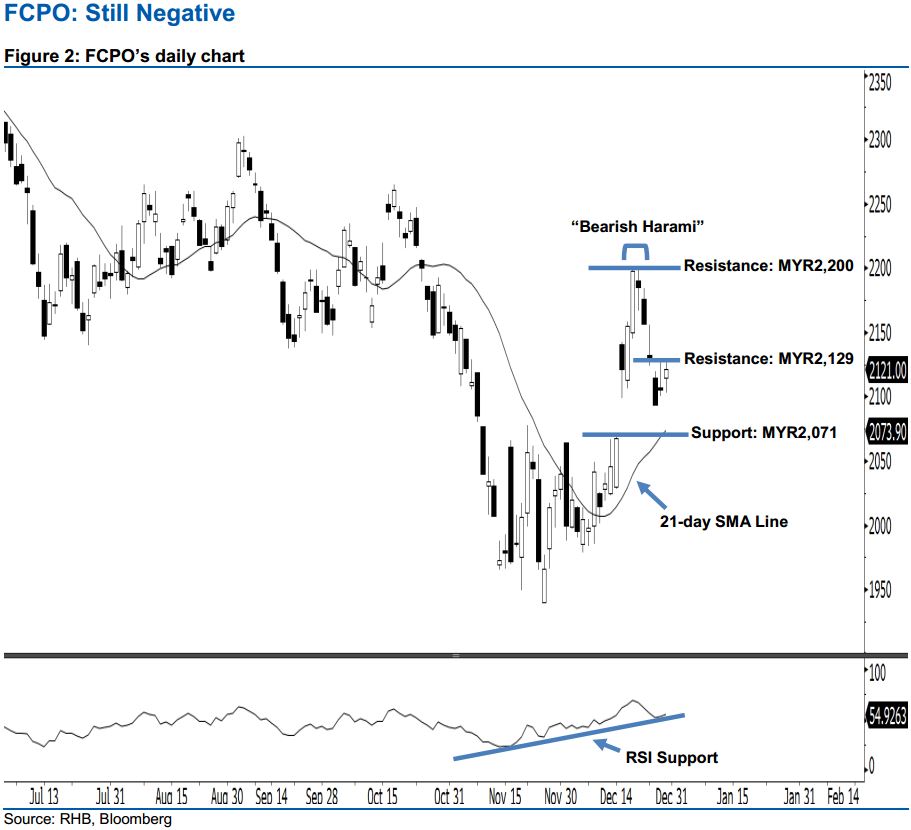

Sentiment remains negative; stay short. The FCPO ended higher to form a positive candle last Friday. It gained MYR13 to settle at MYR2,121, off its high of MYR2,127 and low of MYR2,103. Still, the appearance of last Friday’s positive candle indicates that the market may be experiencing a technical rebound after losses were seen in the past week. As the commodity failed to recover above the recent high of the MYR2,200 resistance, this implies that the negative sentiment stays intact. Overall, we believe that the downside swing – which started from 20 Dec’s “Bearish Harami” pattern – may continue.

Based on the daily chart, we anticipate the immediate resistance level at MYR2,129, determined from the high of 27 Dec. The crucial resistance is maintained at MYR2,200, obtained from the high of 20 Dec’s “Bearish Harami” pattern. Towards the downside, the immediate support level is seen at MYR2,071, ie the upside gap support of 17 Dec. If this level is taken out, the next support is situated at the MYR2,000 psychological spot.

Therefore, we advise traders to stay short, since we had originally recommended initiating short below the MYR2,124 level on 27 Dec. A stop-loss is advisable to set above the MYR2,200 threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 31 Dec 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024