FCPO - Outlook Remains Negative

rhboskres

Publish date: Wed, 02 Jan 2019, 09:09 AM

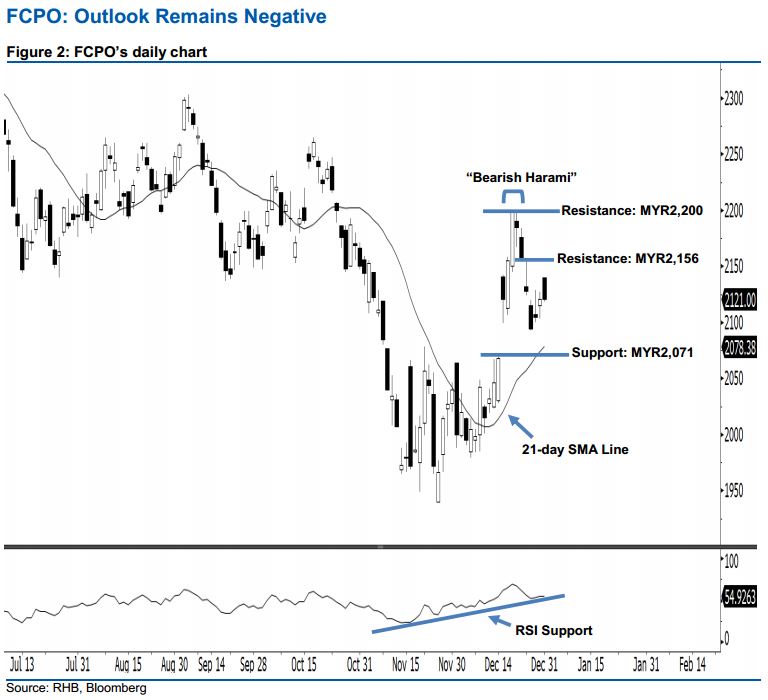

Stay short, with a stop-loss set above the MYR2,200 resistance. On Monday, the FCPO formed a black candle. It dropped to a low of MYR2,118 during the intraday session, before ending at MYR2,121 for the day. On a technical basis, the downside move is not diminished yet, after the commodity posted a black candle below the recent high of MYR2,200 resistance. This may also further extend the downside swing that started with 20 Dec’s “Bearish Harami” pattern. Overall, we keep our bearish view on the FCPO’s outlook.

As seen in the chart, we are eyeing the immediate resistance level at MYR2,156, which was the high of 24 Dec. The next resistance is seen at MYR2,200, determined from the high of 20 Dec’s “Bearish Harami” pattern. To the downside, we maintain the immediate support level at MYR2,071, situated at the upside gap support of 17 Dec. Meanwhile, the next support is anticipated at the MYR2,000 psychological mark.

Hence, we advise traders to maintain short positions, following our recommendation of initiating short below the MYR2,124 level on 27 Dec. In the meantime, a stop-loss can be set above the MYR2,200 threshold in order to limit the risk per trade.

Source: RHB Securities Research - 2 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024