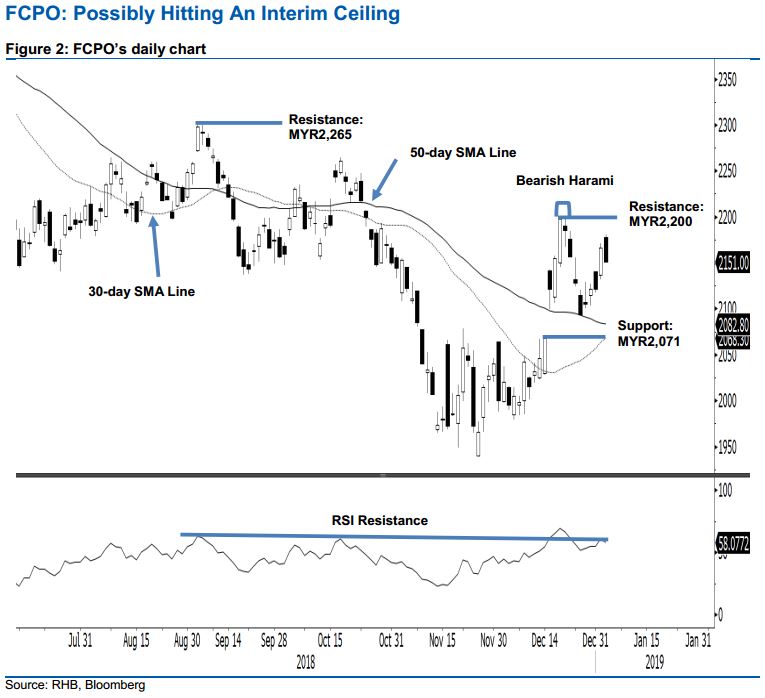

FCPO - Possibly Hitting An Interim Ceiling

rhboskres

Publish date: Fri, 04 Jan 2019, 05:25 PM

Maintain short positions. The FCPO ended the latest session negatively after it failed to sustain to its early session’s positive tone. For the intraday, it registered a high and a low of MYR2,181 and MYR2,150, before closing at MYR2,151, indicating a decline of MYR15. The failure of the commodity to maintain its intraday positive bias may be an early indication that its recent sessions’ positive price movements have probably ended, and the 20 Dec’s “Bearish Harami” formation is still valid. Towards the upside, the commodity needs to decisively recapture the MYR2,171 mark to signal a possible end to the negative bias. Hence, we keep to our negative trading bias.

As there is still no price confirmation to suggest the negative bias that started from the “Bearish Harami” formation has ended, we still recommend that traders maintain short positions. These positions were initiated after the commodity crossed below MYR2,124 on 27 Dec. The stop-loss can be placed at MYR2,171.

Immediate support is set at MYR2,071, the high of 17 Dec. This is followed by MYR2,000. On the other hand, overhead resistance is expected at MYR2,200, the high of the 20 Dec’s “Bearish Harami” formation. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 4 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024