E-mini Dow Futures - Upside Move Likely to Continue

rhboskres

Publish date: Mon, 07 Jan 2019, 10:30 AM

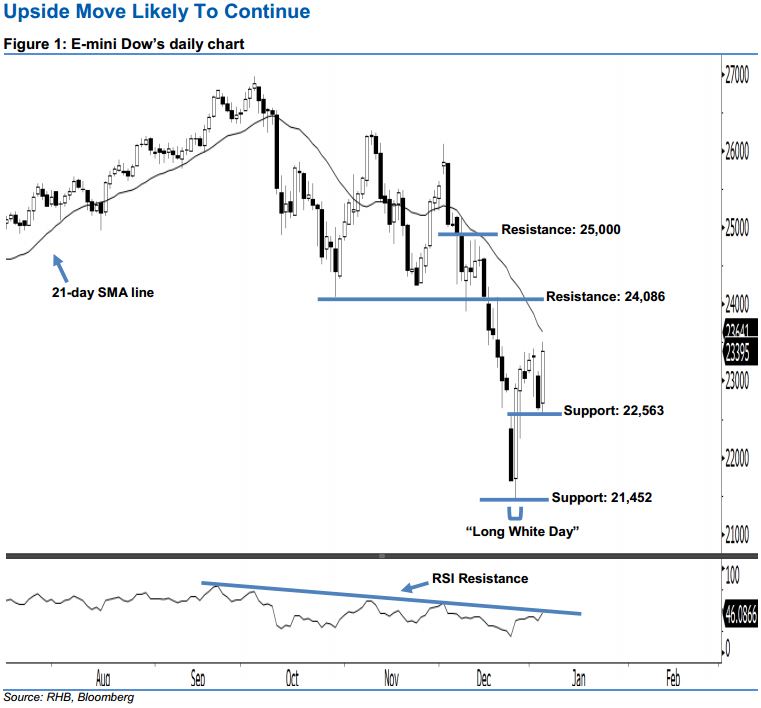

Bullish sentiment remains intact; stay long. The E-mini Dow ended higher to form a white candle last Friday. It gained 736 pts to close at 23,395 pts, after oscillating between a high of 23,504 pts and low of 22,563 pts. Based on the current outlook, we think buyers may have retained control of the market. This was as last Friday’s white candle has recouped the previous session’s losses. Given that the E-mini Dow marked its highest close in more than two weeks, this implies that the rebound that started from 26 Dec 2018’s “Long White Day” candle may carry on. Overall, we remain upbeat in E-mini Dow’s outlook.

As seen in the chart, we are now eyeing the immediate support at 22,563 pts, ie the low of 4 Jan. If this level is taken out, look to 21,452 pts – obtained from the low of 26 Dec 2018’s “Long White Day” candle – as the next support. On the other hand, the immediate resistance is seen at 24,086 pts, ie near the high of 19 Dec 2018. The next resistance would likely be at the 25,000-pt psychological mark.

Hence, we advise traders to stay long, following our recommendation to initiate long above the 22,400-pt level on 27 Dec 2018. A stop-loss is preferably set below the 21,452-pt threshold in order to limit downside risk.

Source: RHB Securities Research - 7 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024