Hang Seng Index Futures - Still Trading Below Downtrend Line

rhboskres

Publish date: Tue, 08 Jan 2019, 09:03 AM

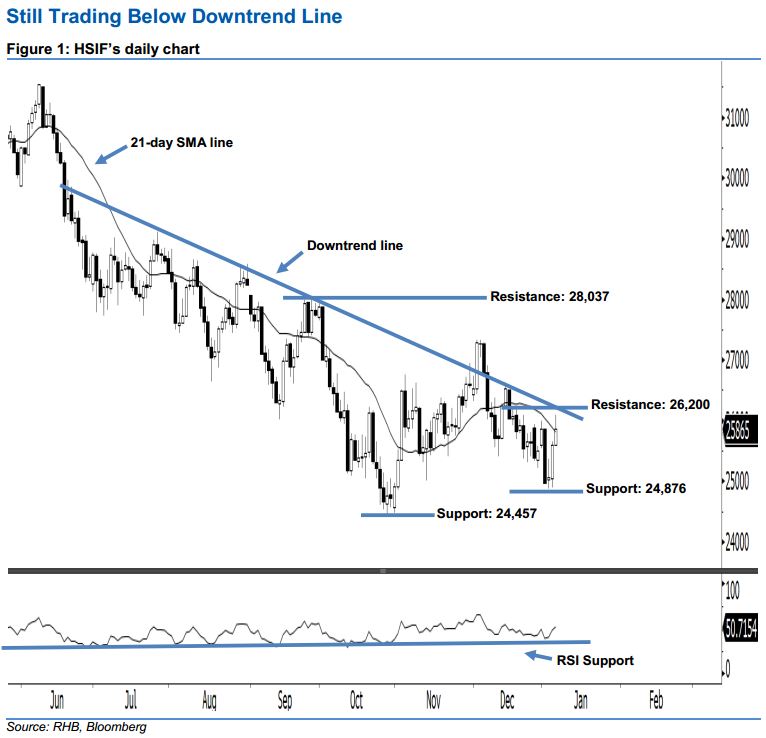

Negative sentiment remains unchanged; stay short. The HSIF ended higher to form anther white candle yesterday. It closed at 25,865 pts, off its high of 26,098 pts and low of 25,588 pts. However, the appearance of 4 and 7 Jan’s white candles indicate that the market may be experiencing a technical rebound following losses seen recently. As the index is still trading below the downtrend line drawn in the chart, this implies that negative sentiment stays intact. Overall, we think that the downside swing – which started from 5 Dec 2018‘s black candle – may continue.

Presently, we are eyeing the resistance at 26,200 pts, set near the aforementioned downtrend line. This is followed by 28,037 pts, ie the high of 26 Sep 2018. On the other hand, the immediate support is seen at 24,876 pts, defined from 3 Jan’s low. If this level is taken out, the crucial support is maintained at 24,457 pts, which was the previous low of 29 Oct 2018.

Hence, we advise traders to maintain short positions, following our recommendation to initiate short below the 25,940-pt level on 28 Dec 2018. A stop-loss can be set above the downtrend line at the 26,200-pt mark in order to minimise the risk per trade.

Source: RHB Securities Research - 8 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024