WTI Crude Futures - Immediate Resistance Gives Way

rhboskres

Publish date: Wed, 09 Jan 2019, 05:35 PM

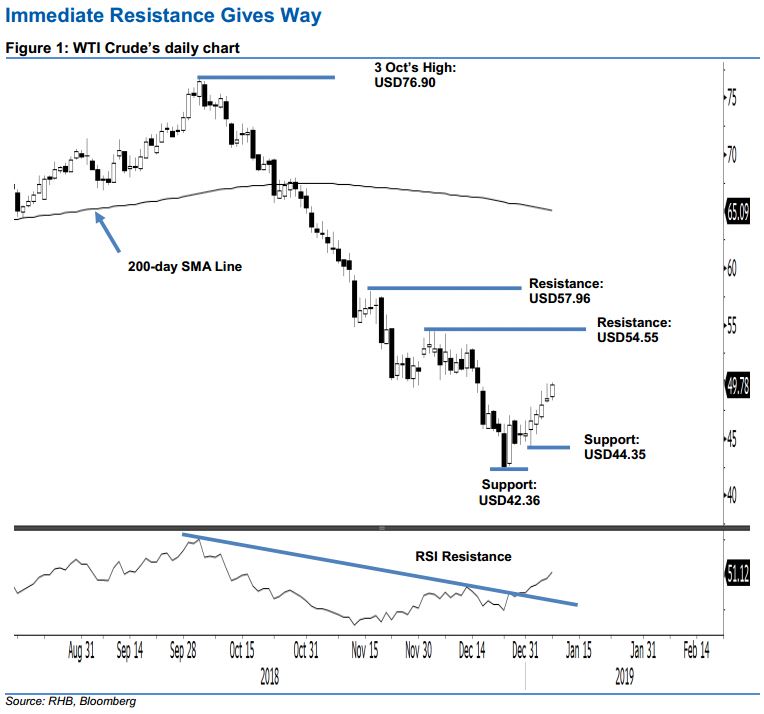

Initiate long positions to play on the rebound. The WTI Crude ended the latest session on a positive note, as it crossed above the previous USD49.41 immediate resistance to end at USD49.78 – indicating a gain of USD1.26. The low and high were at USD48.31 and USD49.95. The commodity has been in a rebound phase over the past weeks, after experiencing a multi-week sharp retracement from early-Oct 2018 to end Dec 2018 – this saw prices reaching a low of USD42.36. As mentioned before, chances are high that the said ongoing rebound phase could be extended should the aforementioned previous immediate resistance be overcome. Consequently, we now switch our trading call to long.

Our previous short positions – which were initiated at USD46.14 or the closing level of 19 Dec 2018 – were stopped-out in the latest session at the USD49.41 mark. As the WTI Crude is now likely to extend its rebound, we initiate long positions at the latest close. For risk-management purposes, a stop-loss can be placed at below the USD42.36 level.

The immediate support is revised to USD44.35, which was the low of 2 Jan. This is followed by the USD42.36 mark, or the low of 24 Dec 2018. Moving up, the immediate resistance is now expected at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 9 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024