FCPO - Sliding Back From The Resistance

rhboskres

Publish date: Fri, 11 Jan 2019, 04:56 PM

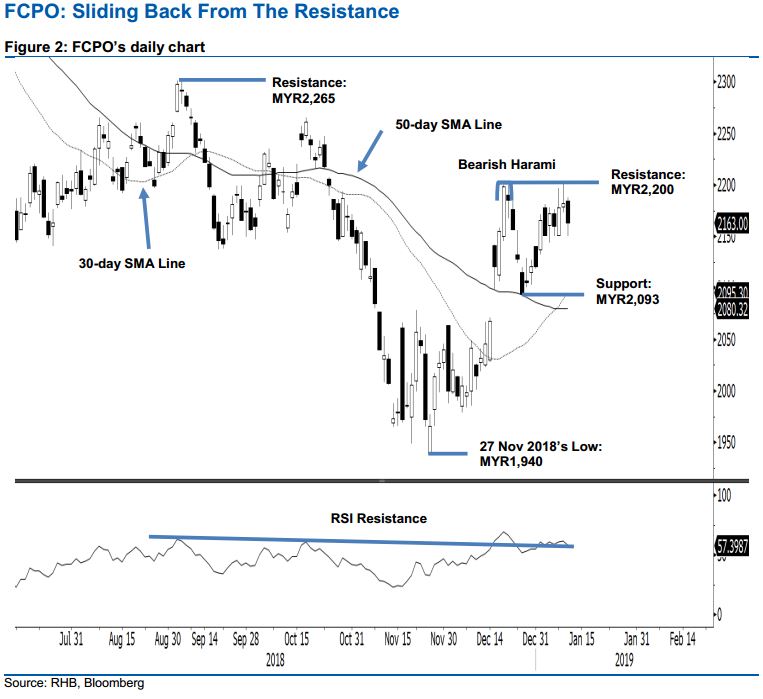

Maintain long positions pending confirmation of price rejection. The FCPO performed weakly in the latest trading. The intraday tone was negative, as the commodity generally moved lower for the whole session – the high and low were at MYR2,188 and MYR2,150, before ending MYR19 lower at MYR2,163. The weak session came after the commodity tested the immediate resistance of MYR2,200 in the prior session – this suggests a possibility of a price rejection from the said resistance mark. However, to confirm this possibility, the commodity needs to breach the latest session’s low in the coming sessions. Until this happens, we keep to our positive trading bias.

As there are no clear signals of a price rejection taking place, we continue to recommend that traders keep to long positions, which we initiated at MYR2,172 – the closing level of 4 Jan. For risk management purposes, a stop-loss can be placed at MYR2,150.

The immediate support is maintained at MYR2,093, the low of 26 Dec 2018. The following support is at MYR2,000. On the other hand, the immediate resistance is set at MYR2,200, the high of the 20 Dec. This is followed by MYR2,265, the high of 17 Oct.

Source: RHB Securities Research - 11 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024