WTI Crude Futures - Rebound Remains in Play

rhboskres

Publish date: Wed, 23 Jan 2019, 05:11 PM

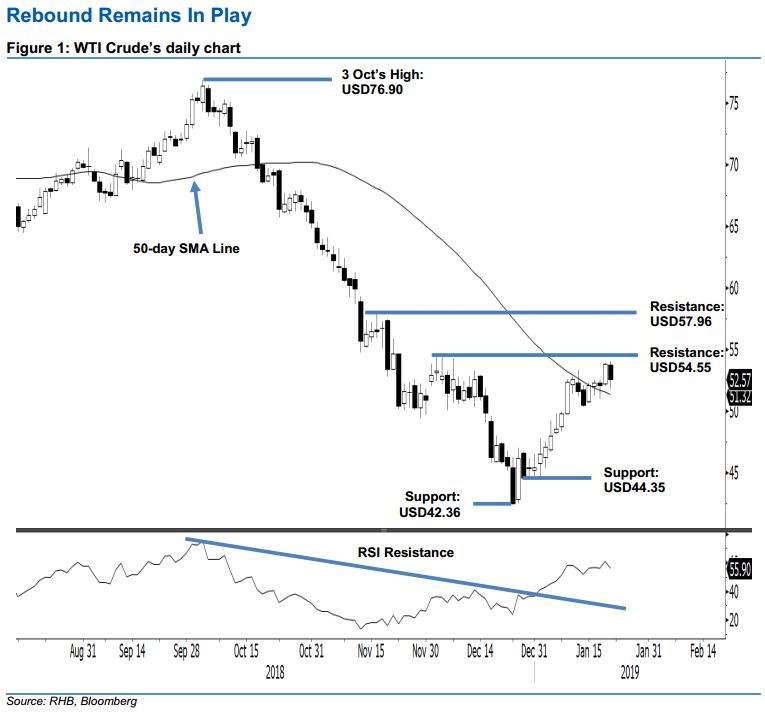

Maintain long positions. Yesterday, the black gold experienced a weak session as it softened USD1.23 to close at USD52.57. The intraday tone was negative as it generally moved lower, with the high and low posted at USD54.02 and USD51.80. The negative session may indicate the bulls failed to sustain the prior session’s positive posture. Nevertheless, looking at the price actions over the past 2 weeks, it is observed that the commodity is still fluctuating around the 50-day SMA line. Should a decisive breakout take place – to be signalled by the upside cross of the immediate resistance of USD54.55 – chances are higher that the rebound could extend further. As such, we keep to our positive trading bias.

As the commodity’s upward move has not shown signs of ending, we continue to recommend traders keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed at the breakeven level.

Towards the downside, immediate support is expected at USD44.35, which was the low of 2 Jan. The second support is pegged at USD42.36, or the low of 24 Dec 2018. Conversely, overhead resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 23 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024