WTI Crude Futures - Sideways Consolidation

rhboskres

Publish date: Fri, 25 Jan 2019, 05:05 PM

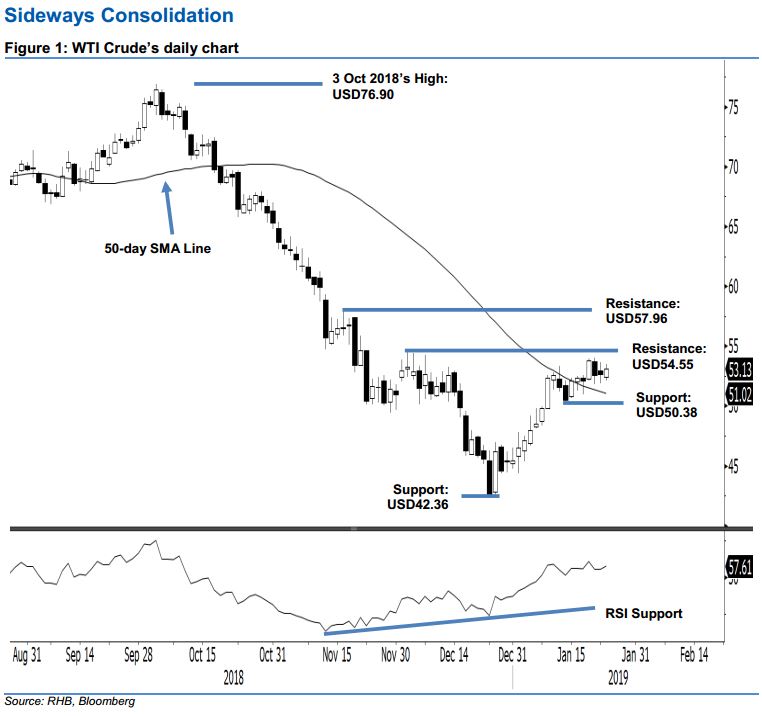

Maintain long positions as the consolidation phase is developing. The WTI Crude added US0.51 to close at USD53.13, as it managed to pull away from the weak earlier session – the low and high were recorded at USD52.07 and UD53.47. Nevertheless, the positive session did not signal an end to the commodity’s consolidation phase – which is taking place in the area below the immediate resistance of USD54.55 and around the 50-day SMA line. This consolidation phase still looks healthy at this juncture and has not shown any signs that could indicate a deeper retracement or the resumption of the downtrend move that started from the high of USD76.90 on 3 Oct 201. Based on these factors, we keep to our positive trading tone.

As the bias is still tilted towards the extension of the rebound, we continue to recommend traders keep to long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stoploss can be placed at the breakeven level.

The immediate support is set at USD50.38, which was the low of 14 Jan. The second support is eyed at USD42.36, or the low of 24 Dec 2018. Conversely, the immediate resistance is kept at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 25 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024