FKLI - No Change in Bias

rhboskres

Publish date: Fri, 25 Jan 2019, 05:06 PM

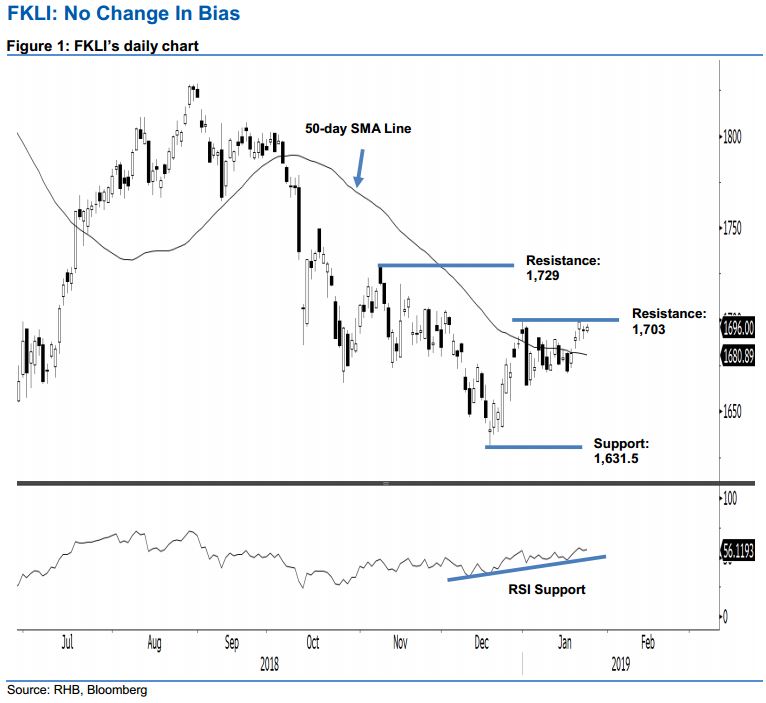

Maintain short positions until price confirmation to signal a change in bias. The FKLI was trading in a directionless range of 1,992.5 pts and 1,697.5 pts, before closing marginally higher at 1,696 pts, indicating a gain of 1.5 pts. Still, the index is capped by the immediate resistance of 1,703 pts. A firm breach above this mark is needed to signal the rebound that started from the low of 1,631.5 pts on 18 Dec 2018 is resuming. So long the index is still capped by this resistance, chances are still high that it may weaken from here. Based on these, we keep to our negative trading bias.

As there is no price confirmation to signal that the bulls have regained the control over the price trend, traders should remain in short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be placed above 1,703 pts.

The immediate support is set at 1,631.5 pts, the low of 18 Dec. This is to be followed by the 1,600-pt mark. Moving up, the immediate resistance is expected at 1,703 pts, the high of 31 Dec 2018, while the second resistance is set at 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 25 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024