E-mini Dow Futures - Upside Move Stays Unchanged

rhboskres

Publish date: Tue, 29 Jan 2019, 10:53 AM

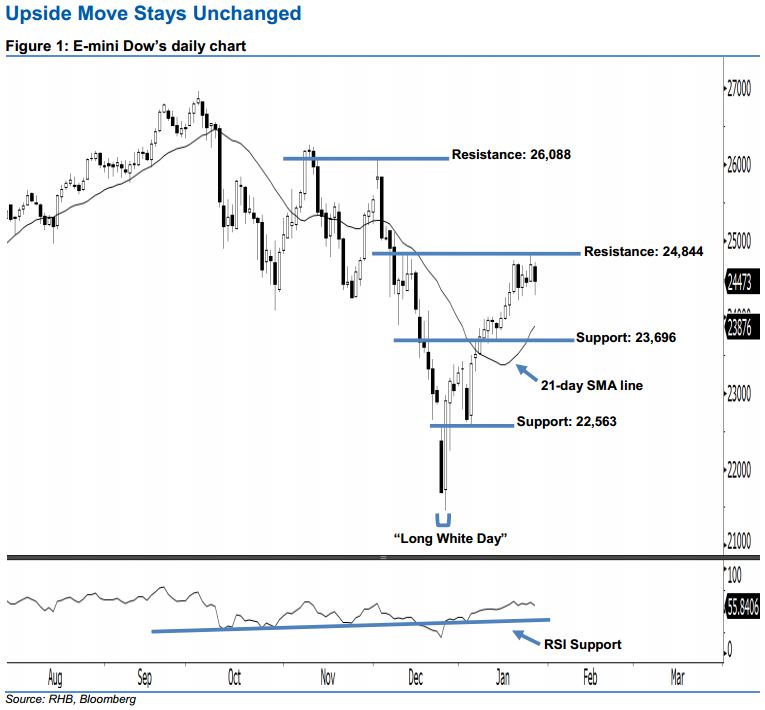

Stay long, with a trailing-stop set below the 23,696-pt level. The E-mini Dow formed a black candle last night. It declined 223 pts to close at 24,473 pts, off its high of 24,712 pts and low of 24,284 pts. Still, the positive sentiment stays unchanged as this candle can only be viewed as buyers probably taking a breather after the recent surge. We think the rebound would likely continue as long as the index fails to break below the 23,696-pt support mentioned previously. Given that the E-mini Dow is still trading above the rising 21-day SMA line, this implies that the rebound that took place from 26 Dec 2018’s “Long White Day” candle may carry on.

Based on the daily chart, the immediate support level is seen at 23,696 pts, which was the low of 14 Jan. The next support is seen at 22,563 pts, defined from the low of 4 Jan. Conversely, we maintain the immediate resistance level at 24,844 pts, ie the high of 12 Dec 2018. Meanwhile, the next resistance is anticipated at 26,088 pts, ie the previous high of 3 Dec 2018.

Thus, we advise traders to maintain long positions, given that we initially recommended initiating long above the 22,400-pt level on 27 Dec 2018. At the same time, a trailing-stop can be set below the 23,696-pt threshold in order to lock in part of the profits.

Source: RHB Securities Research - 29 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024