FKLI & FCPO: FKLI: Lacking a Rudder for Now

rhboskres

Publish date: Wed, 30 Jan 2019, 04:39 PM

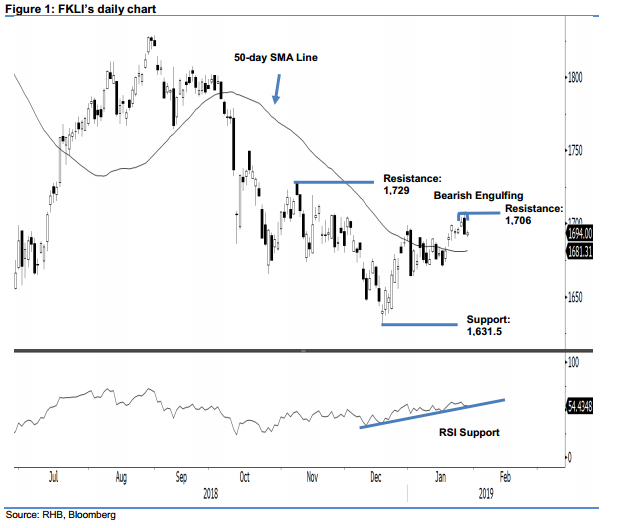

Maintain short positions while adjusting the trailing-stop upwards. The FKLI’s movement yesterday was sandwiched within a relatively narrow band of 1,690.5 pts and 1,695 pts. At the closing, it ended a point higher at 1,694 pts. The neutral session came in after the emergence of the “Bearish Engulfing” formation in the prior session, suggesting the bears may be taking a pause. For now, until the bulls are able to capture the high of the said “Bearish Engulfing” formation, chances are still high for the index to retrace further. Considering this, we keep to our negative trading bias.

With no price signal to suggest the bulls are strong enough to extend the rebound that started from the low of 1,631.5 pts on 18 Dec 2018, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, the stop-loss is revised to 1,706 pts. Immediate support remains at 1,631.5 pts, the low of 18 Dec 2018. This is followed by the 1,600-pt mark.

Meanwhile, the immediate resistance is revised to 1,706 pts, the high of the 28 Jan’s “Bearish Engulfing” formation. This is followed by 1,729 pts, the high of 8 Nov.

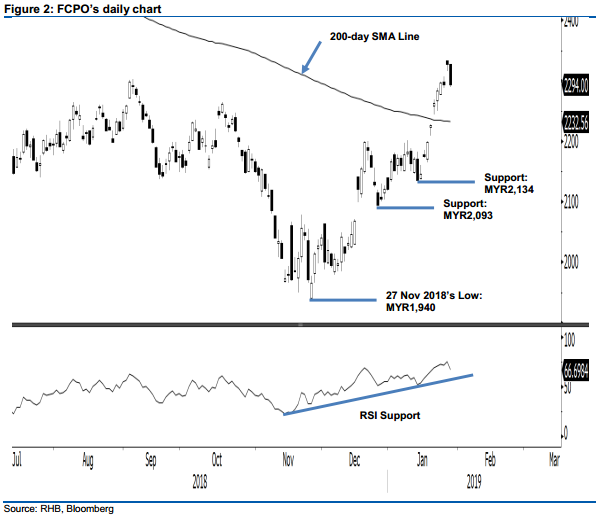

Maintain long positions until further negative price signals emerge. The FCPO weakened sharply yesterday. It closed below the previous immediate support of MYR2,300. The session’s low and high were at MYR2,290 and MYR2,327, before the commodity closed MYR33 lower at MYR2,294. The weak session can be deemed as a possible early sign that the commodity is entering a consolidation phase. This was after the recent sharp upward move that sent the Daily RSI into overbought territory. For now, we will regard a breach of the MYR2,288 level, the low of 25 Jan, as a sign that a deeper consolidation is developing. Until this happens, we keep to our positive trading bias.

Traders are advised to stay in long positions. We initiated these at MYR2,226, the closing level of 18 Jan. To manage risks, a trailing-stop can be placed below MYR2,288, the low of 25 Jan.

Towards the downside, the immediate support is now expected at MYR2,134, the low of 14 Jan. The second support is at MYR2,093, the low of 26 Dec 2018. On the other hand, the immediate resistance maintained at MYR2,348, the high of 29 Jun 2018. This is followed by MYR2,400.

Source: RHB Securities Research - 30 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024