COMEX Gold: No Trend Change

rhboskres

Publish date: Thu, 31 Jan 2019, 04:23 PM

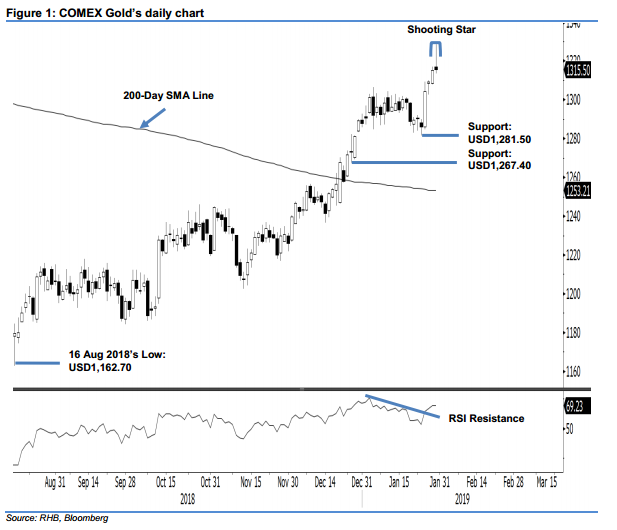

The “Shooting Star” formation has not changed the positive trend, stay long. The COMEX Gold ended marginally higher – USD0.30 – to USD1,315.50, as it gave back most of its intraday gains towards the close. Consequently, a “Shooting Star” formation appeared, with the low and high posted at USD1,313.50 and USD1,328.60. While the emergence of the “Shooting Star” can be an early indication of price exhaustion, further negative price actions are needed to signal such a possibility. We still deem the precious metal’s overall positive price trajectory as intact and retain our positive trading bias.

Until there are clearer price signals to suggest the bulls have weakened in strength, we continue to advise traders stay in long positions. We initiated this at the USD1,216 mark, which was 14 Nov 2018’s close. For riskmanagement purposes, a stop-loss can be placed below the USD1,281.50 threshold.

Immediate support is still eyed at USD1,281.50, which was the low of 24 Jan. The following support is at USD1,267.40, or the low of 21 Dec 2018. Moving up, the immediate resistance is set at USD1,332.40, ie the high of 11 May 2018. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 31 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024