FKLI & FCPO: FKLI: Bulls Are Retracing

rhboskres

Publish date: Thu, 31 Jan 2019, 04:26 PM

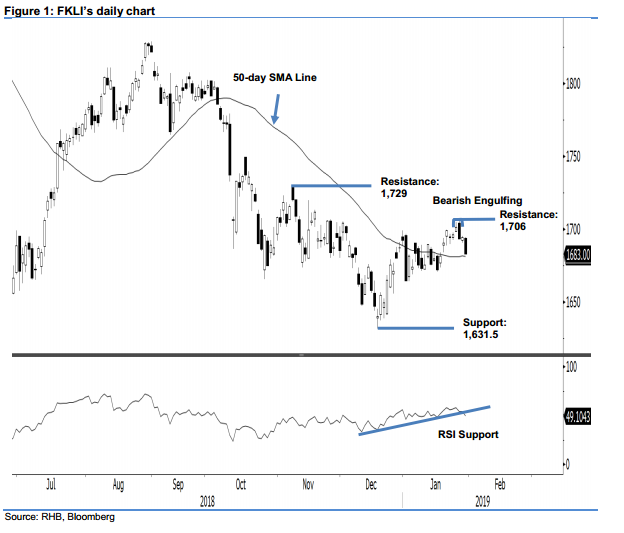

Maintain short positions. The FKLI formed a black candle yesterday, shedding 11 pts to settle at 1,683 pts. The intraday tone was negative as it generally slid lower throughout, with the high and low at 1,694 pts and 1,682.5 pts. The negative session suggests the downward pressure that set in from 29 Jan’s “Bearish Engulfing” formation is still developing. This negative bias would be further enhanced if the 50-day SMA line breached downwards. The Daily RSI, which has also broken the support line (as marked in the chart), points to a weak momentum. As such, we maintain our negative trading bias.

As there is still great risk of the index retracing further, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, the stop-loss is revised to 1,706 pts.

Immediate support is expected at 1,631.5 pts, the low of 18 Dec 2018. The following support is at the 1,600-pt mark. Conversely, the immediate resistance is revised to 1,706 pts, the high of the 28 Jan’s “Bearish Engulfing” formation. This is followed by 1,729 pts, the high of 8 Nov.

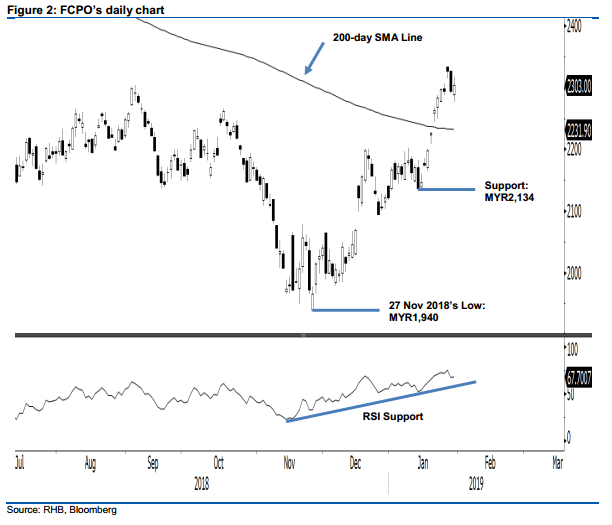

Maintain long positions until the trailing-stop is reached at the close. The FCPO reversed its earlier sessions’ downtrend yesterday, climbing MYR9 to close at MYR2,303. The low and high were at MYR2,277 and MYR2,317. The intraday reversal suggests the bulls are still lingering around – which keeps the overall positive bias intact. For now, if the MYR2,288 point – the low of 25 Jan – is not broken at the close, the risk of the FCPO undergoing a deeper retracement would be contained. To recap, the prior session’s black candle appeared after the Daily RSI flashed out an overbought reading recently. As such, we keep to our positive trading bias.

With no clear price signals to suggest the bears have regained control, traders should stay in long positions. We initiated these at MYR2,226, the closing level of 18 Jan. To manage risks, a trailing-stop can be placed below MYR2,288, the low of 25 Jan.

Immediate support is revised to MYR2,200, around figure. This is followed by MYR2,134, the low of 14 Jan. Moving up, the immediate resistance maintained at MYR2,348, the high of 29 Jun 2018. This is followed by MYR2,400.

Source: RHB Securities Research - 31 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024