FCPO - Testing The Immediate Resistance

rhboskres

Publish date: Fri, 08 Feb 2019, 05:22 PM

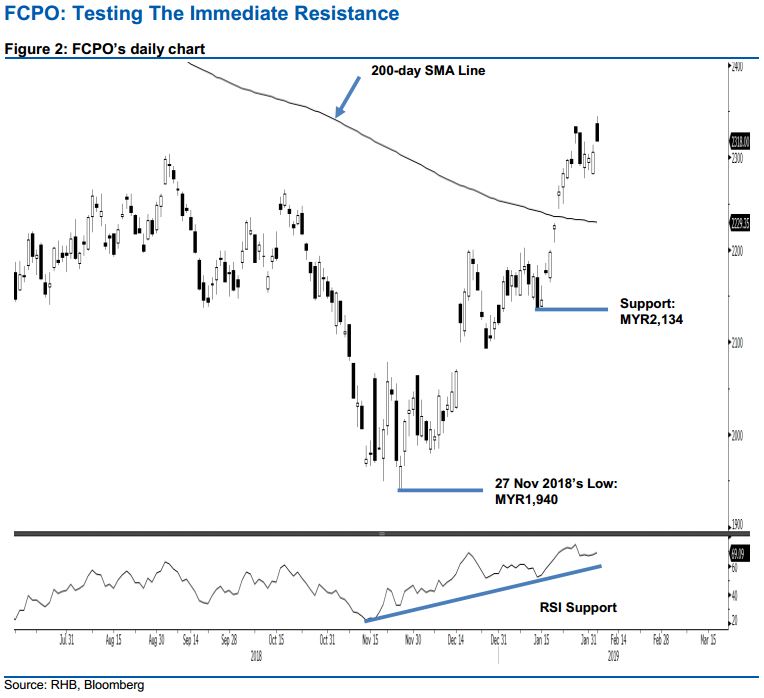

Maintain long positions while keeping the trailing-stop tighter. The FCPO advanced MYR12 to close at MYR2,318 – at one point, it came near to testing the immediate resistance of MYR2,348 with the high posted at MYR2,344, and consequently, a black candle was formed. The appearance of the black candle suggests a possible price rejection at the said immediate resistance mark. For now, we are looking at the downside breach of the MYR2,300 mark as the required signal to suggest the commodity’s upward move has reached an end. Until this happens, we keep to our positive trading bias.

Until there are clearer price negative price signals to suggest the bulls have exhausted their energy, traders should stay in long positions. We initiated these at MYR2,226, the closing level of 18 Jan. To manage risks, a trailing-stop can be placed below MYR2,300.

The immediate support is now set at MYR2,300, a round figure. This is followed by MYR2,200. Moving up, the immediate resistance is at MYR2,348, the high of 29 Jun 2018. This is followed by MYR2,400, a round figure.

Source: RHB Securities Research - 8 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024