COMEX Gold - Support Is Holding Up

rhboskres

Publish date: Tue, 12 Feb 2019, 10:21 AM

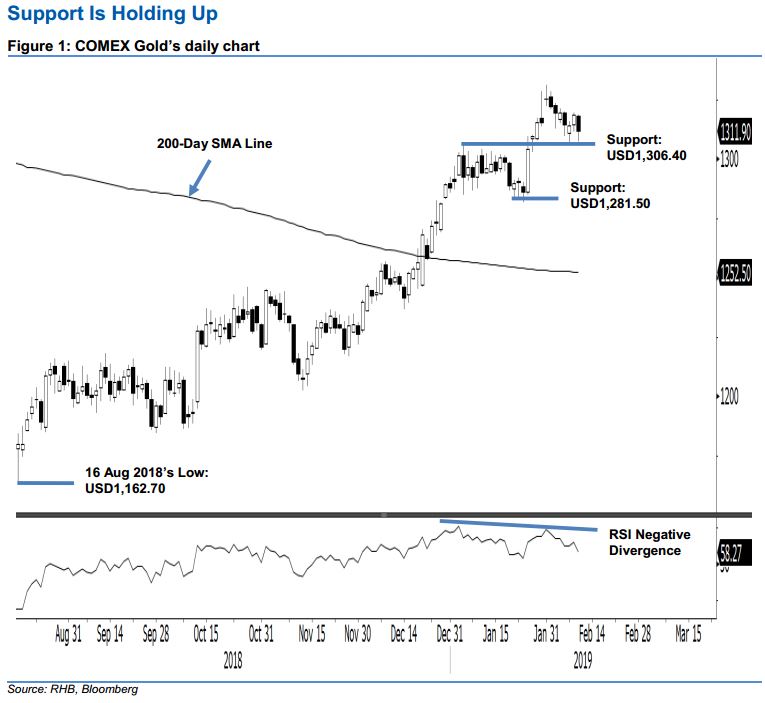

Maintain long positions, until the immediate support gives way. The yellow metal closed USD6.60 weaker at USD1,311.90, this was after it fell to a low of USD1,307.10 intraday – not too distant from the immediate support of USD1,306.40. The high was at USD1,318.70. Broadly, the commodity’s upward trend that started from the low of USD1,162.70 on 16 Aug 2018 is still encouraging. While we note its recent high was accompanied by a negative divergence in the Daily RSI – indicating momentum is fading, the risk for it to experience a deeper retracement would still be contained as long as the said immediate support is not breached to the downside. Consequently, we are keeping our positive trading tone.

As the risk for the commodity to retrace further is relatively low for now, we continue to advise traders stay in long positions. We initiated this at the USD1,216 level, which was 14 Nov 2018’s close. For risk-management purposes, a stop-loss can be placed below the USD1,306.40 mark.

Immediate support is expected to emerge at USD1,306.40, which was the low of 7 Feb. The following support is at USD1,281.50, the low of 24 Jan. Meanwhile, overhead resistance is pegged at USD1,332.40, ie the high of 11 May 2018. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 12 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024