FKLI - No Strength From the Bulls

rhboskres

Publish date: Wed, 13 Feb 2019, 04:53 PM

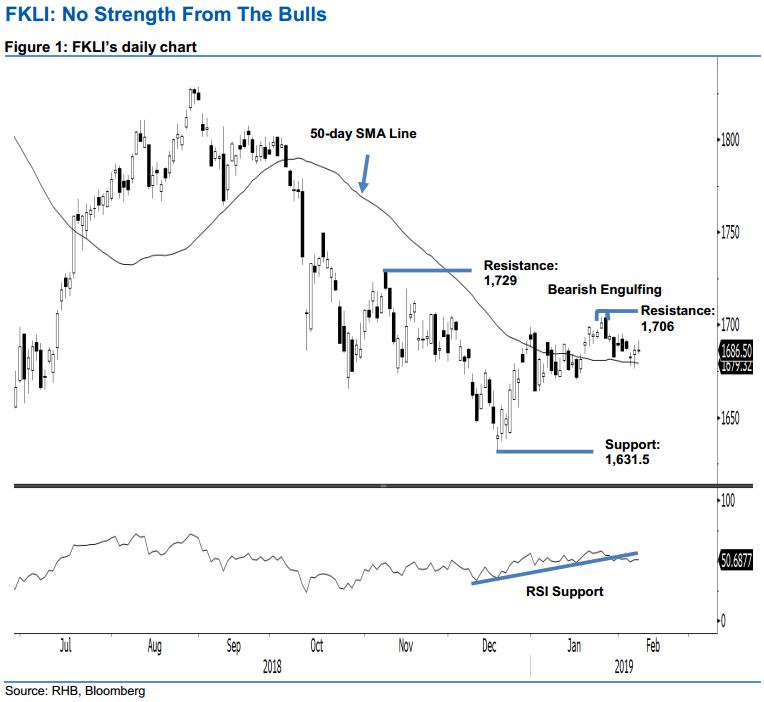

Still eying for further retracement; stay in short potions. The index ended the latest trading flat at 1,686.5 pts – indicating neither the bulls nor the bears were in control. The session saw the index sandwiched between 1,684 pts and 1,691.5 pts. Looking at the index’s price actions since the appearance of the “Bearish Engulfing” formation on 29 Jan, chances are still high for the index to retrace further from its current level. Should the 50-day SMA line, which was tested twice recently, give way, our negative bias would be further enhanced. Hence, we maintain our negative trading bias.

With the bears still lingering around the 50-day SMA line, we continue to recommend that traders maintain short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be paced above 1,706 pts.

The immediate support is set at 1,631.5 pts, the low of 18 Dec 2018. The second support is expected at the 1,600-pt mark. Moving up, the immediate resistance is eyed at 1,706 pts, the high of the 28 Jan’s “Bearish Engulfing” formation. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 13 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024