FCPO - No Reversal Signal Yet

rhboskres

Publish date: Fri, 15 Feb 2019, 05:33 PM

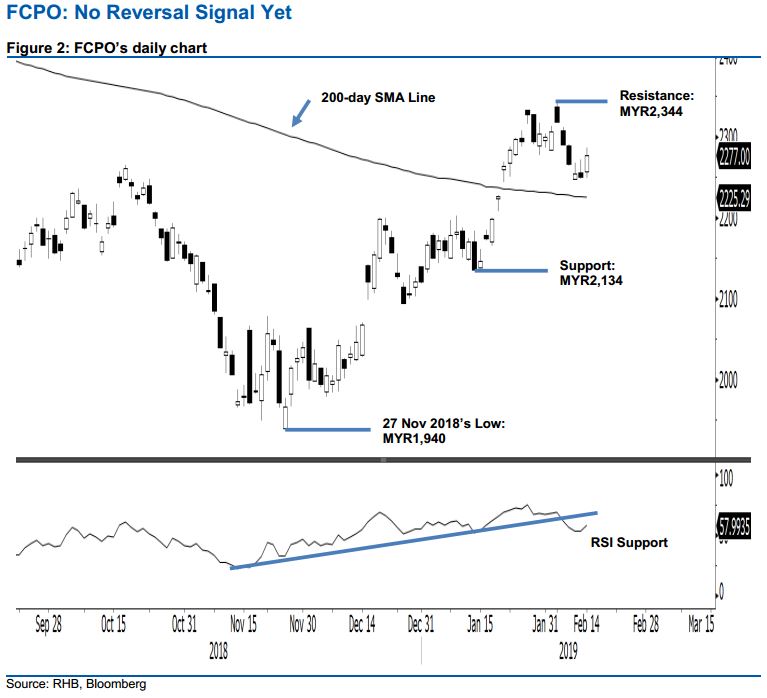

Maintain short positions, as the negative bias remains in place. The FCPO formed a white candle yesterday. The intraday tone was positive as it generally scaled higher, with the low and high at MYR2,249 and MYR2,286. It closed at MYR2,277, indicating a gain of MYR27. The positive session can be seen as the bears taking a breather after the recent retracement – which implies that the retracement (as a whole) remains intact. This ongoing retracement leg set in to correct the commodity’s prior multi-week’s advance. At the minimum, we are expecting the 200-day SMA line to be retested. Our negative trading tone is unchanged.

As we believe the retracement leg is still in the early stage of developing and the 200-day SMA line is likely to be tested – traders should stay in short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a stop-loss can be placed above MYR2,344.

The immediate support is eyed at MYR2,200, a round figure. The following support may emerge at MYR2,134, the low of 14 Jan. Conversely, the immediate resistance is expected at MYR2,344, the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 15 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024