COMEX Gold - Positive Trend Intact

rhboskres

Publish date: Mon, 18 Feb 2019, 11:36 AM

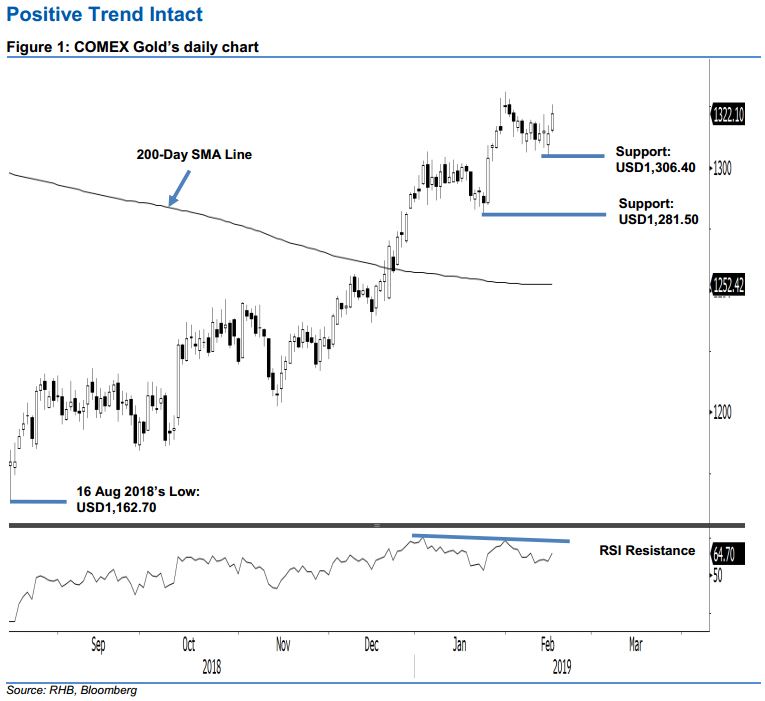

Maintain long positions as it continued to extend rebound from the support mark. The yellow metal continued to exhibit encouraging price action after it tested the USD1,306.40 immediate support mark recently. The intraday tone was positive as it generally scaled higher for the whole session, the low and high were at USD1,314.30 and US1,325.80, before it ended USD8.20 stronger at USD1,322.10. The positive session suggests the commodity’s overall positive price trend is still firmly in place – this technical bias would remain so, provided the immediate support is not breached to the downside. Maintain positive trading bias.

With no price signals to suggest the commodity’s positive price trend that started from the low of USD1,162.70 on 16 Aug 2018 has reached an end, we continue to advise traders stay in long positions. We initiated this at the USD1,216 level, which was 14 Nov 2018’s close. For risk-management purposes, a stop-loss can be placed below the USD1,306.40 mark.

Immediate support target is kept at USD1,306.40, which was the low of 7 Feb. Breaking this may see market test USD1,281.50, the low of 24 Jan. On the other hand, the immediate resistance is set at USD1,332.40, ie the high of 11 May 2018. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 18 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024