FCPO - Moving Closer Towards The 200-Day SMA

rhboskres

Publish date: Thu, 21 Feb 2019, 10:51 AM

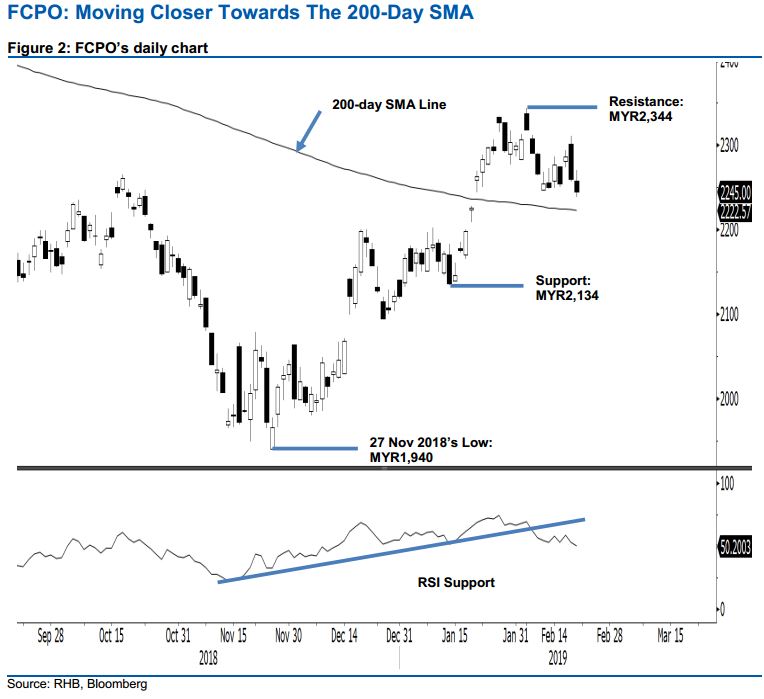

Banking on retesting of the 200-day SMA line; maintain short positions. The FCPO performed weakly in the latest trading. It closed MYR15 lower at MYR2,245 – this was after it slid lower for almost the entire session with the high and low recorded at MYR2,270 and MYR2,238. The weak session was in line with our expectation that the commodity is due for a correction after the prior multi-week’s relatively sharp rally. We continue to expect this retracement leg to see the commodity retesting the 200-day SMA line (current reading: MYR2,222). The daily RSI reading, currently waning, is also supportive of our bias.

Maintain our negative trading bias. As the bears continue to show strength in pushing the commodity to retrace further towards the 200-day SMA line, traders are advised to keep in short positions. These were initiated at MYR2,290, the closing level of 8 Feb. To manage risks, a stop-loss can be placed above MYR2,344.

Towards the downside, the immediate support is set at the MYR2,200 mark, a round figure. The second support may emerge at MYR2,134, the low of 14 Jan. Conversely, the immediate resistance is expected at MYR2,344, the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 21 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024