E-mini Dow Futures - Weak Recovery

rhboskres

Publish date: Tue, 12 Mar 2019, 09:39 AM

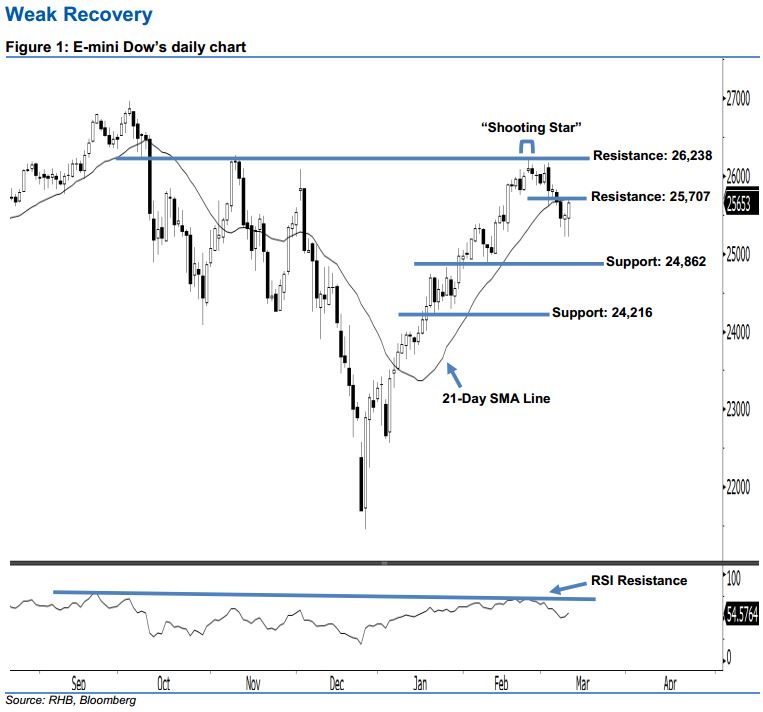

Stay short, with a stop-loss set above the 26,238-pt resistance. The E-mini Dow ended higher to form a white candle last night. It gained 158 pts to close at 25,653 pts, after oscillating between a high of 25,694 pts and low of 25,218 pts. Still, the appearance of yesterday’s white candle indicates that the market may be experiencing a technical rebound after the losses seen lately. As the index does not recover above the recent high of 26,238-pt resistance mentioned previously, this implies that the negative sentiment stays intact. Overall, we think that the downside swing – which started from 25 Feb’s “Shooting Star” pattern – may continue.

As shown in the chart, we are eyeing the immediate resistance level at 25,707 pts, ie the high of 7 Mar. If a breakout arises, look to 26,238 pts – obtained from the high of 25 Feb’s “Shooting Star” pattern – as the next resistance. On the other hand, the immediate support level is seen at 24,862 pts, which was the low of 8 Feb. Meanwhile, the next support would likely be at 24,216 pts, defined from the low of 22 Jan.

Therefore, we advise traders to maintain short positions, following our recommendation of initiating short below the 25,707-pt level on 8 Mar. A stop-loss can be set above the 26,238-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 12 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024