E-mini Dow Futures: Bearish Sentiment Remains Intact

rhboskres

Publish date: Tue, 26 Mar 2019, 12:47 PM

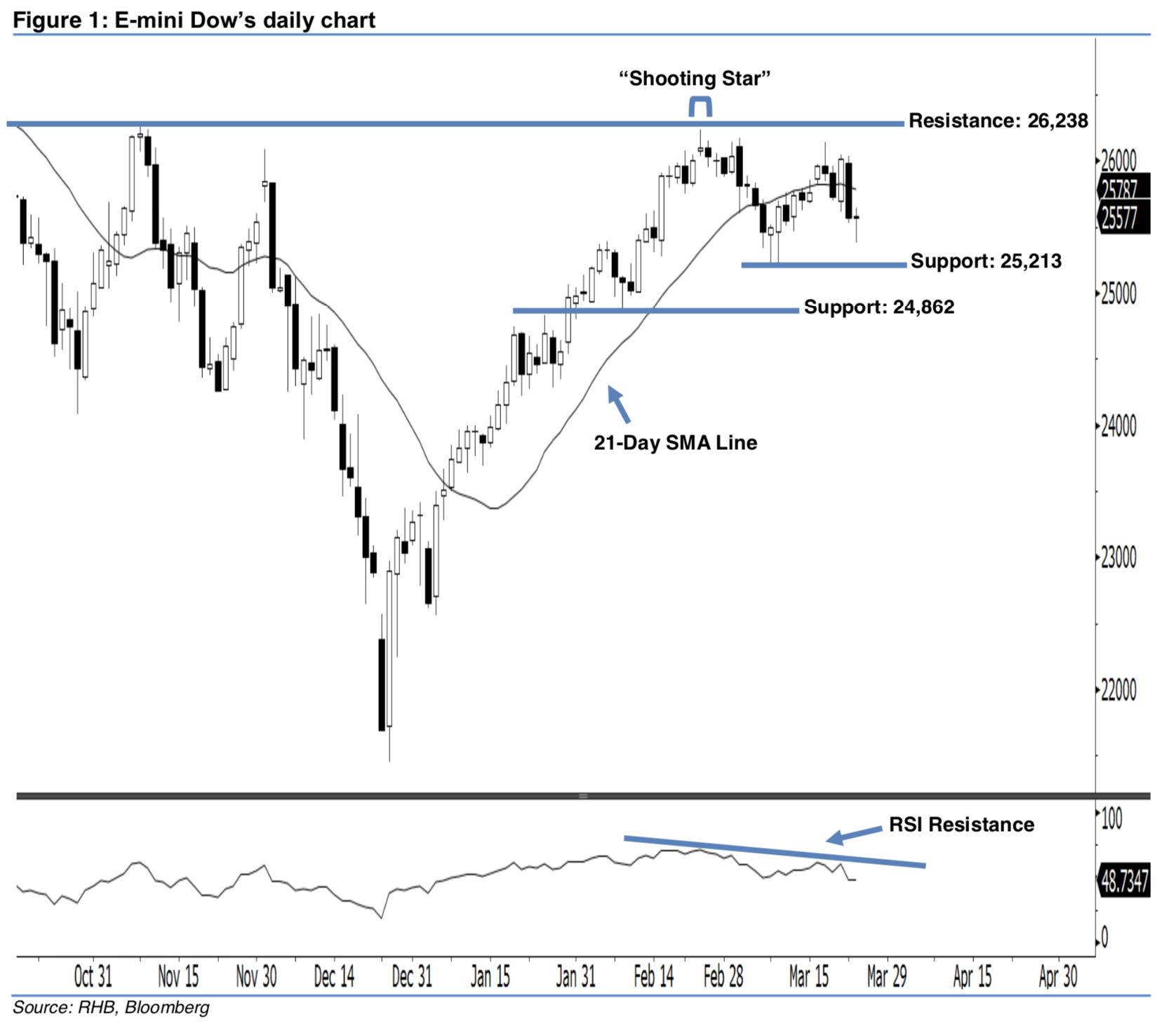

Outlook remains bearish; maintain short positions. The E-mini Dow formed a “Doji” candle last night. It settled at 25,577 pts, after hovering between a high of 25,647 pts and low of 25,377 pts throughout the day. We note that the index is still trading below the 21-day SMA line and the recent high of 26,238-pt resistance, which implies that the bearish sentiment remains unchanged. In addition, the 14-day RSI indicator deteriorated to a weaker reading at 48.73 pts, and the bearish sentiment has been enhanced. Overall, we think that the downside swing – which began from 25 Feb’s “Shooting Star” pattern – may continue.

According to the daily chart, the immediate resistance level is anticipated at 26,238 pts, situated at the high of 25 Feb’s “Shooting Star” pattern. If a breakout arises, the next resistance is seen at the 26,966-pt historical high. To the downside, we are eyeing the immediate support level at 25,213 pts, which was the low of 8 Mar. Meanwhile, the next support is maintained at 24,862 pts, ie the previous low of 8 Feb.

Therefore, we advise traders to maintain short positions, given that we initially recommended initiating short below the 25,707-pt level on 8 Mar. A stop-loss is preferably set above the 26,238-pt mark in order to minimise the risk per trade.

Source: RHB Securities Research - 26 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024