Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Tue, 26 Mar 2019, 12:49 PM

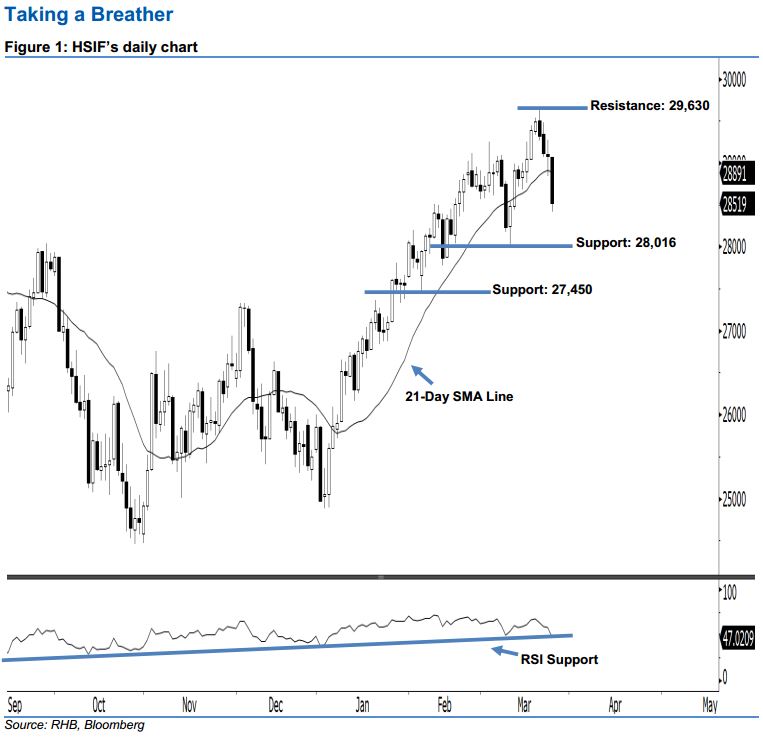

Stay long, with a stop-loss set below the 28,016-pt support. The HSIF ended lower to form a long black candle yesterday. It dropped to a low of 28,422 pts during the intraday session, before ending at 28,519 pts for the day. However, as the index has managed to stay above the previously-indicated 28,016-pt support for nearly two weeks, it suggests that the upside move is not over yet. We think the bulls may continue to control the market as long as the HSIF does not erase the gains created by 11-12 Mar’s white candles. Overall, we keep our positive view on the index’s outlook.

Based on the daily chart, we maintain the immediate support level at 28,016 pts, ie the previous low of 11 Mar. If a decisive breakdown occurs, look to 27,450 pts – which was the low of 8 Feb – as the next support. To the upside, the immediate resistance level is at 29,630 pts, defined from the high of 20 Mar. The next resistance is situated at the 30,000-pt psychological spot.

Thus, we advise traders to stay long, following our recommendation of initiating long above the 29,039-pt level on 20 Mar. A stop-loss can be set below the 28,016-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 26 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024